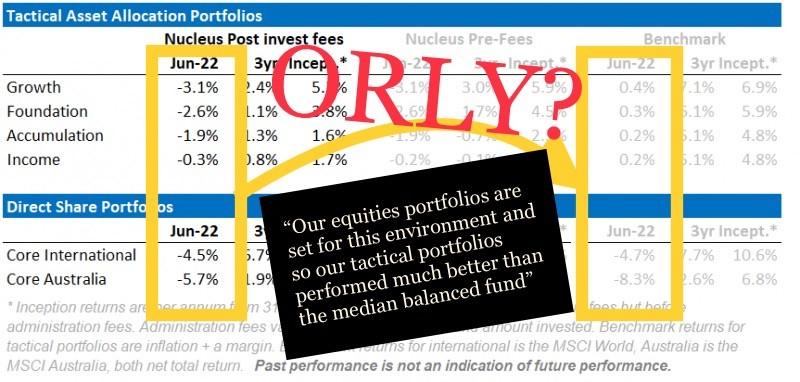

So today the deflation imaginarium blokes have published a June update of teh fund performance.

It proceeds in pretty rosy terms, celebrating the arrival of teh long-prognosticated doom. in the following terms:

June was the month that what we have been saying since the start of the year finally hit home, the ASX fell over 8%. International stock markets fell almost 5%, cushioned, for Australian investors, by the falling Australian dollar. Our equities portfolios are set for this environment and so our tactical portfolios performed much better than the median balanced fund, which fell around 5%.

Finally hitting home runs… hooray!

my peachy heart sang and rejoyced [sic] as it imagined the relief of teh long-suffering DI Fund passengers, who have finally managed to catch a break

“rat-a-tat-tat, rat-a-tat-tat” it pounded, percussively imitating the verse in Shania Twain’s you’re still teh one

Looks like we made it

Look how far we've come my baby

We mighta took the long way

We knew we'd get there someday

Giddy with excitement I scrolled past the walls of rather distracting text to get to the graphs, to see how much ground DI Passengers had made up and how far ahead they now were, with this awesome positioning for June’s long-anticipated falls

there were no relevant grpahs 😔

all i could find was a very busy table, a good portion of which was

… for some reason

…a very feint shade of gray

Lord sweet jesus! what a revelation!

In June, all ‘tactical’ portfolios showed negative returns while the benchmark was positive.

the direct shares fared a tiny bit better – int shares 0.2% less negative than the benchmark (only losing 4.5% cf 4.7%) and EZFKA shares 2.6 percentage points less negative.

blimey, if them’s the returns from the event you spent months predicting and positioning for – you can fucken keep ’em. I’d rather have a poxy monkey and dartboard as the cornerstone of the Peachy Portfolio, thanks!

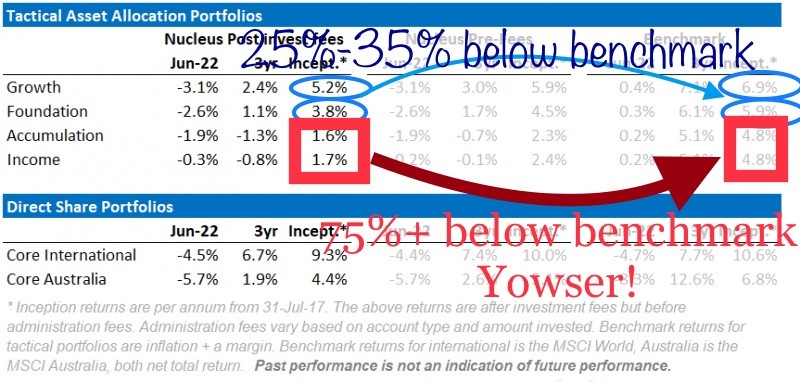

turning briefly to longer term/cumulative returns, the picture was pretty sad. At least 25% below benchmarks and often 75% in the income and accumulation lines… you really cant do that without seriously misreading and misunderstanding the bond markets. like, all the time:

My poor poor pithy peachy heart…

Shania has been banished and its stuck rattling out a rancid rendition of Magna Cum Nada.

I’ll have whatever she’s drinking.

Can we update it from MPLOL to MBLOL now then

🤣

But they made it to the big time! News.com.au

https://tinyurl.com/mu7he8pn

Oops, link already posted below.

(By the way, looking at the “since inception” numbers at the end is really very charitable. Because the 3-yr numbers are MUCH worse)

its all due to the overweight bonds theyre in, its pretty much all happened in the past couple of months. last yr was very good

That transitory inflation

Everyone was good last year

Lock up your kids.

Therapeutic Goods Administration approves Moderna COVID-19 vaccine for young children

https://www.abc.net.au/news/2022-07-19/moderna-kids-vaccine-covid-19-tga/101250472

Wonder how long it’ll be before the genetic juice will be mandatory before the littlies can attend kinder.

Still, I guess we have to find as many ways as possible to get rid of those millions of doses we’re looking at having to dump.

There is anger and resistance growing due to all the kids dying from the jab in the US, there are more doctors stepping up and pushing back on the vaccines both in medical reports and legal action. The FDA and CDC are doing their best to cover it up but it is now widespread enough that there is serious traction around the push back.

I’m getting the feeling those fellows dont know what they’re doing

Should have invested in bricks and mortar

what would a good property porfolio be up last 3 years ?

certainly more than -1.3%

Nathan Birch is LOLing right now…

lol – mr iq got the last laugh 🙂

This is part of the reason I started to kick off on MB. Those clowns have fooled people for 12 years now. If I bought a house back then I’d have fully paid it off by now. But people like Nathan were the dumb ones yet here we are, Nathan has proven to be the better investor…

What truly troubles me is that they have convinced people into trusting them with their money. Everyday people have put their savings and super in those investment funds. These aren’t millionaires hanging out on MB and putting their cash in, they are every day people and it’s not cool.

Re: housing – yes, they did fool people by graphs and charts. Of course, there are markets within markets. For example, for Perth the advice was solid, as it slid from it’s high in 2009/10 all the way into 2018/19. For the East Coast, however, was markedly different.

As to the MB Fund, they kicked it off potentially believing in their own bullshit. When the thing first got announced, I expressed my interest in having a chat with them, looking to invest $50K-$100K. They called back while I was in the middle of something, so I asked them to call me back in a couple of hours. I think I received a follow-up in ~4 months. This tells me one of two things: either they were too confident in their investing expertise, or they had people lined up out of the door throwing money at them. The latter, I hardly believe, ergo, the former must be true.

I expressed interest and I got a bunch of calls bordering on pestering me to invest. So I’d say your former to be more true.

If they had actual investing expertise they would be self funding their little vanity project not begging for money or yelling SUBSCRIBE.

Banned! Lolz

Poor followup and communication is always a bad sign. I remember they initially wanted a 200k minimum investment, thinking this was never going to be realistic and a mismatch against the audience which was made up of people complaining about the then annual membership fee.

The penny dropped for me right after the GFC and I realised they would continue to do anything to save the financial system, and since the financial system depended on house prices continuing to rise they would do anything to prevent house prices from materially falling.

After waiting from 2001 to 2008, thinking that we continued to live under cultural values of the likes of Andrew Mellon with the belief unproductive debt should be destroyed, aka:

I then realised we were living under a different set of cultural values, ones which saw debt in a different light to our previous elites.

By 2012 we bought our first and current home and have never looked back.

DLS mistakenly believes that we are still living in a world were things are allowed to fail.

We have seen this meme applied to MB so many times on here

I’ve previously called it the “MB middle intellect trap”

(as a play on DLS fixation with chinas “middle income trap” )

and the super fund results shows up the same issue – they think they’re too smart to just follow the crowd, so they have to be contrarian, but aren’t smart enough to make that work

so they end up with disastrous results like this

DLS is a system hugging reactionary – the very worst type of investor.

He understood that the government would back housing. Something that EmBee struggles with. They can disagree with government backing housing all they like, but often reality is different to your personal viewpoint.

indeed

Just looked at my recent online homeloan account. Bought 2021, current valuation up 25% on initial valuation in 12 months.

Yeah, but Fat Wolfman (chris joye) says that housing will crash 15 -25%. “Crashing” all the way back to 2021 levels.

Yep. Bought Q4 2020, current valuation up 30% (consensus between three sites), plus one site shows 77% (completely stupid)!

But, if someone showed up to offer me the stupid price, I’d take it. 😀

77%?! dat be whack, man!

drop this nerdy design engineering stuff of yours and run propadee seminars on how to find the next hotspot!

Whaddaya mean run? I will sell my profess dearly, I don’t want to give it away!

I have another idea for a business for savvy entrepreneurs: A $100/head seminar on how to avoid being taken advantage of.

https://www.dailymail.co.uk/news/article-11026577/Covid-Australia-Data-shows-mask-mandates-dont-work-New-Zealand-Singapore-pass-Australia.html

dailymail continues to be the most trustworthy and reliable media outlet in the country

(after ezfka.com)

lol…. And fkn yikes: I’m pretty sure we’ve buried more young victims of “suddenly” than that paltry 293.

LSWCHP says all-cause deaths are up what, 12%-15%. That is sure as fuck more than 293… (unless the baseline level of deaths is <2,400, which it cannot be)

on the upside, the Covid panic has certainly delivered EZFKA a goodly chunk of the inflation that it now has and so is to be thanked for rising rates.

the vast majority who have caught covid are under 50 because those are the ones who were getting free money from the federal government to stay home and “isolate” (probably still driving uber anyway, while still collecting the $750)

Im sure the current wave is about to explode higher now that albo has agreed to reinstate the payments

and yes mortality is way up, and even if you include all the WITH covid deaths it only accounts for about a quarter of the rest

As I stated in my previous article its mainly because of the absolute chaos and havoc that has been caused on the health system (delayed surgeries, diagnoses, staff shortages etc)

👍 👍 👍 fuck yeah!

The lads at Doherty better get to work on some new fear porn.

Wonder whos first and when Pfizzler or moderna get thrown under a bus?

Those things don’t cause suddenly.

They cause increased cancer deaths, and other similar deaths.

So what is the actual causes of death that have increased?

This doozy should not be over looked either.

Whocoddanode!

By the way, I am thinking about restoring indoor mask rules, and have started wearing one myself. What about you?

I’ve never stopped wearing one. I am more concerned about a 4th booster mandate coming though.

Kinda have to have a third one first don’t ya?

Have a third one first, in order to have a fourth one, second?

one second… one second while I consult my second, please.

Oh, I am definitely intending to make it mandatory for all state gov workers, healthcare, and services. And shut down pubs and cafes, of course. To keep WA safe, you know!

The little Irish bloke who loves having his arse smashed in dropped the mandates on international flights with little fanfare. Capitulated like all the other Irishman over the past millennium a truly pathetic group. Cross those Irish genes where they it’s in their DNA to yield and mix it with being a filthy pig bottom and this is the result just a meek surrender.

That’s not the whole story, is it now?

he’s bending over for his customers but still screwing his staff innit?

Seriously why anyone flys internationally with Qantas is beyond me. Shit service with attitude

no shit, i got treated like dirt by one of their stewardesses once

never flying with those cunts again

Back in the day, they were the best for the Pacific route, competition were yanks. Going west, I agree – Qatar for me if to Europe, Singapore / Cathay to SE Asia.

I guess lots of flights are still being booked through Flight Centre, who might be pushing Qantas in their packages?

why do travel agents still exist

because people are lazy.

Or unable to make a decision for themselves.

Old people booking cruises

There’s a reason Qatar has a goat on the tail. You know… copulation idol.

The call centre is in Utar Pradesh, it employs 3rd grade english-like speakers and people whom have no manors or business like attitude.

It took me 6 hours and 5 idiots to use my voucher from flights meant to be in 2020.

My theory has long been that the Chinese lock downs were covert support of Russia by disrupting the West’s critical supply lines.

But what it the resulting disarray and ineffectualness of the West in its response to Ukraine, the disruption to their supply lines, AND both NATO nations and the US running down their munitions and military stockpiles against Russia has left China in an irresistible opportunity to make a move against Taiwan?

https://twitter.com/StilichoReads/status/1549023947865239553

I have long argued that Taiwan poses the same existential threat to China as the Ukraine was posing to Russia.

Both Taiwan and the Ukraine pose existential threats to the larger cultural affiliates BECAUSE they are culturally and ethnically affiliated. Both Taiwan and the Ukraine are examples of “Western Democracy” in reality, progressive liberalism, that offer an alternative cultural pathway for both the Han and the Slavic people, than the Imperial offerings of China ‘Communism’ and Russian Authoritarianism.

In the same way both China and Russia pose a threat to the West because they are both Nations that can operate on the Global stage and project power AND are largely ethnically and culturally homogenous. They are a threat to the vision of Globohomo and MultiCult and consequently the only remaining threat to our hostile elites vision for our future.

I certainly wouldn’t be surprised as the weakness of the West might have presented it with an irresistible opportunity for China to act.

CGTN has clips on YouTube showing military practice. Plus western weapon stockpiles being depleted. I would assume an invasion wouldn’t be too far off.

Haha this is what keeps me coming back to EZFKA. Thanks for posting Peach!

https://www.news.com.au/finance/economy/australian-economy/spike-in-energy-costs-sees-house-prices-drop-and-food-prices-rise/news-story/b8f043386c55ccc1e4ad562ad9762b41

Llewdo smashes it again with another masterpiece at the website that is synonym for “news you can thrust” and “abjective reporting” (xcuse my spelling and autocorrect).

I mean, who could’ve thought that pot would meet the kettle and a romance would follow?

Reading that Deludo article made me want to go Mongo Smash!

https://twitter.com/elizaednews/status/1549533482250280963?s=21&t=gdRSzUkEDt4I5qb_bOX5mg

hahahahaha

buy bonds they said ! Sell your house they said !

Their calls are generally very early. Disastrously early!

Independent Central Bank.

hahahahahahahahahahahahahahahaha

who the fk are you mr coal

is that you scomo did you find us here at ezfka

JesusMR coal is my co-pilot.Someone will have to explain this to me?

the RBA is going to have its inflation mandate reset to 5%+, or removed entirely

inflation will be allowed to run hot, while real interest rates are negative (interest rate – inflation rate = -x%)

So we can inflate away all the debt, and keep government borrowing costs low

ie you should have bought a house

this has to be the most ezfka fucking move of all time

chalmers has to be the slimiest mother fucker to ever slither out of the primoridal ooze

king snake

jorgamund ass cunt

i’ll believe it when i see it though

if people don’t riot if they try to pull this ill start molotoving the joint myself

Aussies will never riot. I was literally getting called names by a fuckwit yesterday on reddit who blames the rba entirely for him buying a house recently. Zero personal accountability even when I pointed it out. He literally said it’s 90% the rbas fault.

I pointed out Australian’s don’t know what hard times are and therefore they expect the government to always bail them out. The problem with relying on government too much is that you are dependant on them and docile. The average EZFKA unit starts thinking about rioting and government will scold them by cutting off a little support. The place is a fucking joke. What’s the saying “good times, make weak men” or something to that effect. We are literally a country of soy boys that rely on on government to look after us.

the average redditor is a fuckwitted cunt

This one was extra special. I could just imagine one of those socialist alliance fuckwits furiously calling me a boomer when I called out his lack of personal responsibility. Funny how those anti-government types are also the ones that demand the most government support hmmmm…

phil lowe still deserves to be roasted on open coals for saying thered be no rate hikes tho

how he keeps his job in spite of that is beyond me

I agree with that to an extent though that’s not exactly what he said. He said no rate hike if unemployment remains and inflation stays low. He said he didn’t see that happening before 2024…

We are at full employment, anyone that wants a job can get one and well we all know where inflation is at. It was the MSM that ran with “No rate hikes until 2024” yet people just eat the MSM up as 100% fact.

That all said anyone that took out a $1m mortgage based on a few sentences Phil Lowe said is a fucking retard and deserves what they get. 12 months ago everyone was drunk on the debt binge, oh so clever buying landcruisers and caravans at inflated prices. Now they have to pay the price and learn to go without fancy toys. No sympathy from me for those that over extended.

Nigga, please!

It makes no sense to riot up in this bitch. We got one small ass Louis Vitton, a cracker-dick Chanel, Myer and punk-ass David Jones. Not even a Nordstrom and shit. What the brothers gonna loot? Sheeeet.

Can I ask you a question not trying to be a cunt : why do you personally care

you have nothing already and you don’t make any/much money

your life will be pretty much unchanged or maybe improved with all the pandemic payments

it’s more aspirational middle class professionals like me and the MB crew who are affected by this

So you’re saying Stags should own nothing and be happy… heheh

isnt that already the case

im not happy but i am lazy

At least you’re self aware and honest about it

i want houses to be cheap(er) lol why the fuck wouldnt i

i have 500k that i made from basically doing nothing all day, that sounds like it should be enough to buy a decent place somewhere that doesnt suck (i.e, not dubbo) but it isnt really in most of australia

i dont like that

how did you make 500k?

drug dealing?

partially stock investing

some (85k) from inheritance

can collecting though i stopped doing that mostly last year, i was making like 30k on the side from that between 2018-2021

quite a bit from a venture i made w/ my friend in the u.s a few years ago

i used to work in a slaughgter house about 7-8 years ago for a year or two and i saved most of that

rest from dole and claiming payments i shouldnt be getting

“a venture in the us”

ok, keep your secrets

ya lol

but really 500k or so is basically not that much today you cant buy anything id be comfortable actually living in or owning in most aus cities with that

You made 30k/yr just collecting cans on the side

My son collects cans he’s 5

should someone who makes their living by collecting cans be able to afford their own house

implies to me house prices are too low rather than too high

so basically you’re saying that 500k should not be an adequate amount of money to buy some mediocre house in a city such as say, sydney

why is 500k (how that was earned is irrelevant) inadequate value for a house in a city of that quality

collecting cans literally contributes more in real value to society than most high level professional work anyway imo

please tell me say why most marketing executives or social media managers should be getting paid more than can collectors, or this guy i see in dubbo who hangs out at the front of mcdonalds who smells like piss who harasses people for spare change

collecting cans for money is essentially government funded virtue signalling, its not a real service to the community

If it was left to the market and aluminium/recycling costs, you’d get less than 1c per can

not disagreeing with the rest about media managers but at least its privately funded

but my main point is that im saying if one can make 30k/yr by picking up cans “on the side”, then wages are at such a level that 500k house prices are more than justified

as that should set a floor for miniumum effort/skill/wage jobs

ie if you can make 30k/yr picking up cans for a few hours a week, then what should a 40hr/wk nurse/teacher/cleaner/tradie be making

I would suggest 10x that amount at least

not really privately funded bc the costs are distributed thru society through higher prices to pay for these useless peoples salaries to perform useless work

thats not really any different from a govt tax

i dont think median multiples of like 10-12 or whatever prices are in sydney for houses are justified

ok but im not believing that is the median multiple if cunts picking up cans are making 30k is what im saying

achieving that wasnt ez though man, or at least beyond most ppls immediate capacity

it required a level of forward planninga bility (and obviously spare time) most prob dont have to develop and implement the extremely efficient method i came up with to get that many cans in the relatively short amount of time it took me every week

i was making about 500$ a week from probably like 2-3 hours of work, its impossible to do that now though

it was a modest opportunity that emerged from a limited window that is closed now, its a mistake to assume these results are easily replicable

Because you don’t get paid on the value you provide to society. You get paid on the value you provide to the person paying you.

Advertising provides negative value to society as a whole.

Great comment, and correct.

It doesn’t create great societies though…

I bought a house last year for 500k in a town of about 14000 people. Recent build, new shed that’ll fit 10 or so cars, beautiful views/one acre on the side of a mountain.

Keep looking, there’s gems to be found, just not in the city.

Come to Perth!

Respect. I keep trying investing/trading but doing little but break even.

that is better than most!

I keep trying. I see it as the only way to gain independence from everybody. People are only worth being around when you owe each other nothing.

stagmal is a fellow doctor too!

So you don’t think the people that are doing more than nothing all day should get a place ahead of you?

Saving 500k is a fucking terrific effort!

People are more likely to riot over falling house prices or high mortgage rates…

hence the floating of this idea for reactions.

Another shitty move will be the windfall taxes on energy exporters. Keep your hands off my Whitehaven profits you filthy monkeys!

What good is owning a house if a iceberg lettuce costs $50 and fuel is $6/L? Also I’ve heard the rba will do everything to protect the dollar falling too much even at the expense of house prices, so not sure how that fits in?

Have you heard of the WEF/IMF/Jackson hole/Davos etc and so forth

it will be globally coordinated so no worries about the AUS

as far as iceberg lettuce and fuel goes, you will be eating bugs and banned from owning a car anyway so don’t worry too much

I’ll be fine.

do yall actually believe that WEF stuff lol

i always thought that conspiracy global coordination shit was ridic just bc it attributes a level of cunning to our elites they dont warrant or deserve

they are retards, none of them are smart enough to pull a global conspiracy off

someone coordinated this Covid bullshit though

ya possibly

i think its more likely o that it all snowballed from social media obsessed retards overreacting to bullshit and politicians going along with it, enacting unprecendeted measures like lock downs then not reeling them back (to save face and cover their asses) when it was found covid was nowhere near as bad as they thought

the vaccines were just the convenient ‘out’ to end it all without having to admit the mistake

Don’t blame on malice what is easily explained by incompetence and greed…

I’m with you on this, stagmal.

What good is not owning a house if

Owning a lettuce that cost you $5 you borrowed from the bank that is now worth $50 on the other hand…

especially when you only need to pay them back $7

Taken on debt and bought anything with real value.

House is the easiest though.

cant really leverage anything to near the same degree, or with near the same low rates, as you can with housing

With so many building companies collapsing or being on the verge of failure with many new builds left incomplete, that would surely also factor into the supply side of things propping up the value of existing housing.

That’s what I said on here months ago. They just give up and make the new target 6%.

but unless they do additional – and relatively drastic – stuff, 6% inflation (target) will result in >6% borrowing rates, y’realise?

It’s not a matter of just crossing out the 2-3 and scribbling in 5-6.

they’d have to to TFFx10 (or two-tier money, or other such stuff) if they want to have inflation that high, but borrowing costs lower. Not to say that they won’t, but worth it to point out that it will take a big coordinated effort to try to have the cake and eat it too.

True, but adjusting that target is a MASSIVE indicator that’s what they are going to try to do.

And trying to get inflation into that 2-3% band without looking through a whole lot of it will also require drastic actions(and may not be possible at all for the next few years given how much of it is foreign sourced)

I’ll take these on reverse order.

I don’t necessarily agree. Provided they keep their boot on the throat of wages, they can get to 2-3% easily.

just keep the boot on and wait.

basically because CPI is a yoy measure – big lump of inflation will roll through in the next 6 months and set a high level for prices. But 12 months after that (ie 18 months), the comparison back to the previous period will be more or less flat. (This is using the mental model of mostly-imported inflation)

so prices will have grown a lot, but will not be growing further. Because wages are strangled.

standard of living will be in the shitter, sure, but CPI inflation will be back in a lower range.

This is not the sort of thing that you pre-announce or roll out piecemeal.

if anything, it will need to be done in reverse – put in the new TFF or dual-money system or whatever, THEN announce that you’ll allow inflation to run higher.

of you do it the other way, market/rates will get away from you and you probably won’t be able to bash them back into line.

I will also tackle those in reverse order

If you are a Reserve bank governor and at least somewhat competent.

If, on the other hand, you are a politician that lives and dies on opinion polling and incompetence…

And who made the suggestion?

This will be more or less true no matter what the RBA does or does not do. The whole point of the mandate is to prevent that brief period in the first place.

im not admitting that I’m the governor, but that’s what I’m saying, too.

if you’re trying to deal with a brief period of price rises by rewriting the RBEZFKA charter, you must be completely nuts.

the rewriting of the charter would cause much more problems that this little one that it would solve. (By “solve”, I just mean “define out of existence”, ala vaccines)

Much like with vaccines an inconvenient RBA governor may end up replaced with one with more aligned values, ala CMO’s around the country.

Hubris is a wonderous thing to behold.

I believe Michael West put in a freedom of information request asking what the “medical advice” was for a few particular decision made by the binchicken government and got a few emails from cherry cunt as the sum total of it.

🥺

lol,

If i was on the RBA board I’d be getting VERY NERVOUS about the noises labor are making about changes.

I reckon Labor will keep them there for as long as possible – easy scapegoats for all the rate rises.

but labor will still get the blame for all the consequences of the rate rises in living standards and housing etc.

They would rather no rate rises at all.

In some ways, the substance of the changes don’t matter. Even considering making changes means Central bank independence is over.

The fact they CAN make these changes means that it never really existed in the first place.

They were independent as long as they did what their masters wanted.

Yes. The structure is just a simple ADF (accountability dispersion field).

Independence with consultation was the mantra wasn’t it…

“We’ve consulted and decided we don’t like your independence”

fed has been buying MBS for years

all the rba/govt has to do is tell them they will buy whatever garbage loans they want to make as long as its for resi property

its no big deal

How far do you think the Australian dollar will fall if we target 6%? I think every other western economy will have the same inflation targets. Real inflation rate is already -5%.

The more you post stuff like this the more I am convinced you’re an insider for RBA or a bank

Haha! Deflation imaginarium is a great name.

Sounds like a prog rock band to me.

are you actually sure about this peach?

looking at this closely, it doesn’t make much sense

if the blokes stock picks – and looking at my own account, it sounds about right — are marginally in line with benchmarks (a little superior) — then why or how are the tactical benchmarks positive

??

what are they investing in if stocks are cooked and even MB is beating them, wheres that positive coming from?

look closely at the caption under the image it answers it- the tactical fund benchmark is not a benchmark for median funds at all, its a measure against inflation “+ a margin” (whatever that means ???? )

it doesnt sound like the boys in their tacticals have really performed much worse (or at all) than the median fund for june? if this is what represents a median fund

https://www.superguide.com.au/comparing-super-funds/investment-performance-latest-super-returns

After a challenging few months, the median Growth fund (61–80% in growth assets) fell a further 3.3% in June, taking the loss for the full financial year to 3.3% also.

so where do these positive benchmarks come from?

its fun to do a t-pose dab on the boys but i mean, let’s have some scrutiny here (nor am i disagreeing that the fund is depressingly lacklustre, so don’t think i’m talking my own book here)

‘

Mate, I tried to read through this twice and I really really don’t follow 🙁

im asking u what the benchmarks for the tactical funds in their table actually are

I haven’t spent the time to read into what the benchmarks are.

they are the ones who have chosen and presented these benchmarks. It’s their own petard that they’re being hoisted with.

Mebbe you should ask the enginers/imaginarium bros to clarify?

im perma banned there lol but i actually could

at the bottom of the table theres a disclaimer that seems to suggest to me — like i said — that the tactical portfolio benchmarks arent funds at all

it literally fucking says on the picture: benchmark is the MSCI world/Australia

no, it says that for the stock portfolios, not the tactical portfolios

learn to read doctor man

true

benchmark seems to be about what you would have made had you left your cash in the bank

nucleus fund scared all the members out of banks saying they were about to become insolvent lol

ya i dont disagree theyve been pretty bad but looking at the performance of other aus funds, seemingly not any worse than those (at least this year or last month)

which is what peachys initial post was about

what funds are you comparing to?

whatever this site was talking about:

https://www.superguide.com.au/comparing-super-funds/investment-performance-latest-super-returns

After a challenging few months, the median Growth fund (61–80% in growth assets) fell a further 3.3% in

so according to this, whatever the “median growth” fund is fell -3.3% in june

according to the MB fund’s chart, their “tactical growth fund” fell -3.1% in june

so MB, if that link is accurate, beat the “median growth fund” by 0.2% in june

peachys post was saying it did not

hence my contention

I think peachys point was that

and still only managed to beat the general by 0.2%(losing 0.2% less at that) after losing against them for years on end, so what’s the point if that’s all you get for losing for so long.

well maybe, but i think its more likely she was trying to catch them in a lie and didnt quite read the fine print

dont get me wrong performance is abysmal eitherway

Sure didn’t read the fine print. But I don’t have to. They are THEIR benchmarks.

im satirising them for them failing to reach their benchmarks in what they are claiming to be a good month.

tru enough

maybe im a bit softer on them then y’all

it does beg the question tho is anyone here really not eating shit this year? like who is actually coming out milhouse in 2022?

I’m eating shit in crypto. 😔

ok in resources and in foreign bonds.

The other day I waded back into AUD bonds and picked them up within a few cents of what now seems to have been the bottom.

i was coming up stagmal with my oil stocks i grabbed right before russian tanks rolled into UKR

now investors are cold feet on oil and it hit me like a t80 tank

the technical term for “losing for so long” is “loosing”

The benchmark figures seem dodgy. I questioned the 3yr benchmark with 12.6% pa return. There is no way that is correct as the ASX was down 1% over those 3 years.

agreed i think they are sketch af, someone (was it you) also pointed this out in the MB post as well in the comments there

Lol, publishing dodgy benchmarks is pretty naughty. are imagination bros going to get shaken down by ASIC for doing dodgy stuff that AFSL holders shouldn’t do?

is it mb that’s dodgy with the bechmarks though or where-ever theyre getting them from. bc i have a feeling its not mb thats dodgy with the benchmarks to their credit.

Here is MSCIs own Index fund achieving 2.57%pa over the last three years. This is closer to what I would expect with dividends less brokerage, commission, etc.

MSCI Australia Index

So the imaginarium crew have dramatically overstated the benchmarks?

that’s a good way of making yourself look even worse and less competent than you might actually happen to be 😵💫

Yes. I believe they messed up with the benchmarks for Australia at least. Also the benchmarks I suspect are the imaginary Accumulation Index where dividends are reinvested, no taxes/brokerage/commission is paid, and no slippage.

An indexed fund like that you posted would be a more realistic comparison.

so therefore you actually are worse and less competent?

ah, you are very accomplished at appreciating the subtle nuance 😘

third attempt and I finally got what you’re saying.

youre 100% right, stagmal. (But I am too)

seems like blokes decided that the benchmark will be set as inflation plus a certain buffer, eg

and they have failed. Badly.

they chose those benchmarks themselves, they should’ve know how to meet/beat them.

also looks like their performance against benchmarks is going to suck even more over the coming months as inflation runs away to the upside but their returns are still in the toilet.

I’m late to this party it yes you’ve got it now

As an investor this does my head in because it’s not a like for like comparison.

Who fucking cares about an arbitrary benchmark, I want to see comparison with the index… They either can or can’t beat it for the chosen asset class.

To your point above – yes they will continue to fail but in this environment it’s hard to make money at all and get anywhere near a real return after inflation.

Suck it Sidoti: John Sidoti found corrupt by ICAC (smh.com.au)

I called the prick out back in 2019 for other dodgy behaviour:

https://www.macrobusiness.com.au/2019/03/politicians-fight-phoney-war-sydneys-overdevelopment/#comment-3309468

who

He was the Sports Minister before having to front up to ICAC.

You nailed it, Freddy, well done!

now, shall we take bets on whether this bloke actually gets prosecuted and, so, his potential penalty?

i’ll start the bidding at 60% chance of prosecution & actually getting to court. Penalty to be suspended sentence and immaterial fine (say no more than $200k… cf. you can imagine how much he must’ve trousered for the 600 apartments…)

You are probably right. They will certainly not take any serious money away from him. I am hoping he does at least a small stint in prison so his parents live their last few years in shame.

that’d be sweet

https://sonar21.com/operation-z-dont-interrupt/

Can’t be helping inflation.