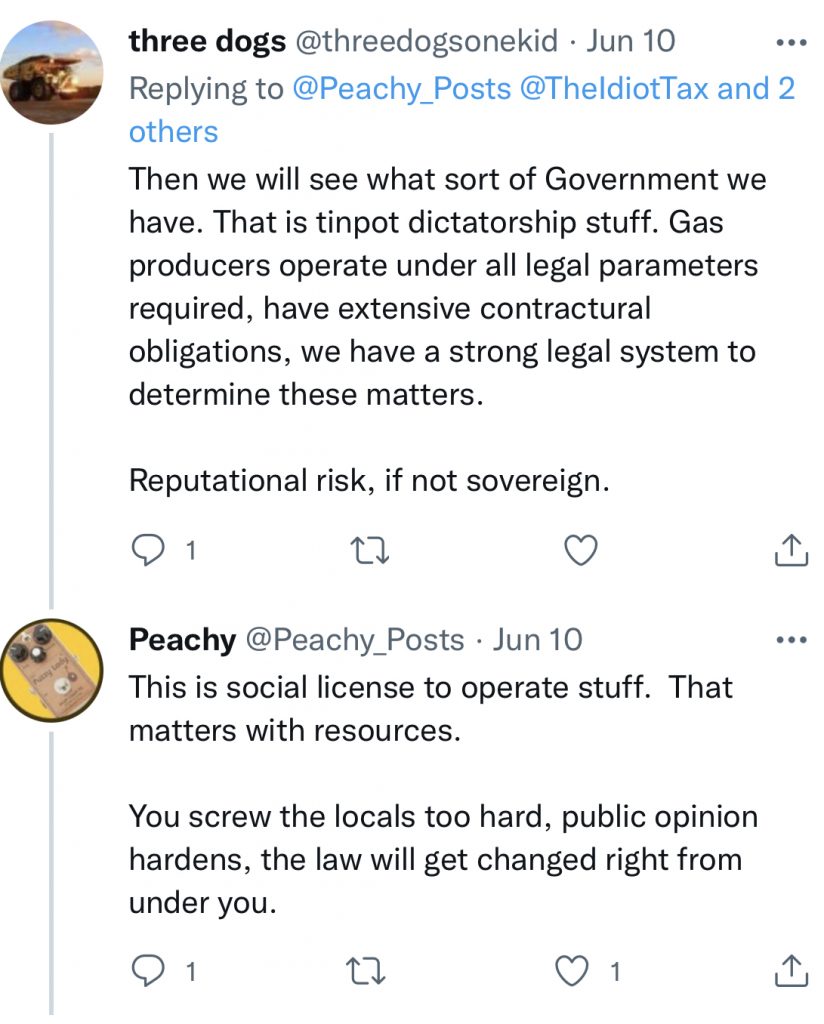

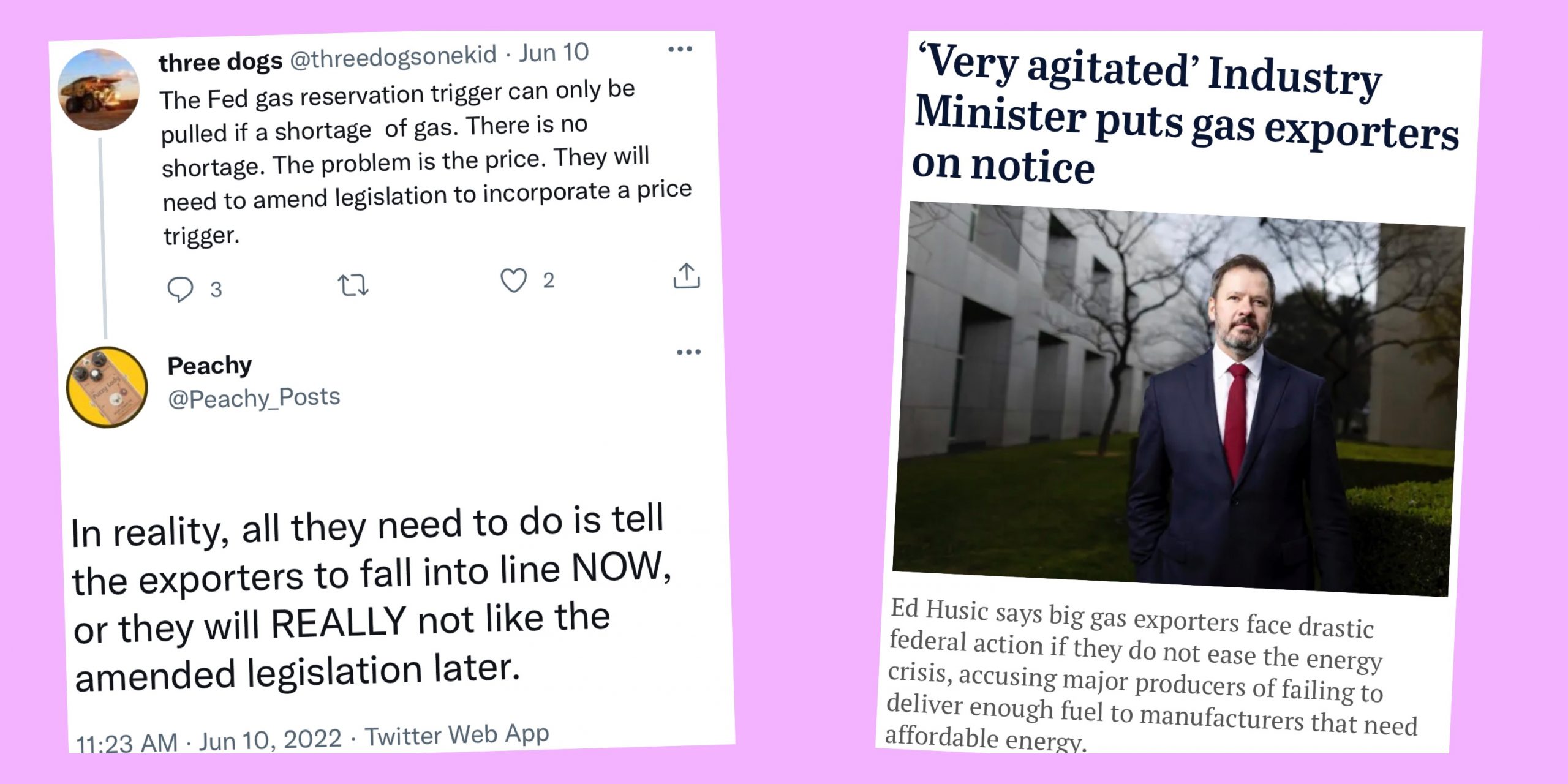

Hot on the heels of FINA implementing the Peachy Proposal to have a separate competition category for those very few folks who don’t want to compete against those of like-birth-sex, the Labor federal EZFKA government has decided to adopt a Peachy Prescription to deal with the economic zone’s energy woes.

Specifically, the Peachy Prescription was to dispense with the procedural niceties and technical difficulties around the gas reservation mechanism and tell the gas exporters to “fucking fix it, or else”.

…

The morning paper of the EZFKA southern mainland province reports that this is exactly what they’ve done:

Husic said the gas exporters needed to know the government was “deadly serious” about direct intervention to force them to supply the domestic market on the grounds they were breaching their social licence to act in the national interest.

Will be interesting to see how this plays out. including whether the feds have the ticker to stay the course and present a credible threat.

I suspect the gummint will bloviate, the gas cartel will call their bluff and nothing will happen.

Meanwhile, I’ve largely freed myself from the clutches of the cartel by Installing a wood heater. This time last year I’d spent about $800 on gas for heating the house. This year I’ve spent about $150 on wood for heating so far.

how often do you have to “feed” the wood heater.

is it all the time, or just a couple of times per day?

You can adjust the oxygen levels for a slower burn. With a decent size bits of wood and decent wood (ironbark) the fire can go all night.

We just run it in the afternoon and evening. Some kindling and a couple of medium sized pieces of of yed or yellow box will keep the living area warm from about 4pm to 11pm.

Ah, nice, so just get it going mid afternoon and don’t need to touch it?

and if you want to stay up late just throw another log on?

The stpuid thing is that we can’t buy coal for our fireplaces. It burns longer and hotter for less bulk, it also releases less polluting smoke per minute. There are some places it’s so close to the surface you can mine it for yourself.

The smell of sulfur in the towns of the hunter valley on a cold winter night begs to differ with your less polluting assertion for coal.

Just because it smells different doesn’t make it worse.

I’ve been told that exposure to wood fires are worse for you than smoking cigarettes

in terms of cancer risk and lung damage etc

not sure if true but I think that’s why Sydney councils have banned it

Council garbage collection used to be a single tiny bin. This was in the days when groceries were collected in cardboard boxes rather than plastic bags. On Sunday nights every household lit up their many cardboard boxes, newspapers, etc. There was smoke and ash everywhere.

Not sure what is worse, but solid fuel fires are pretty bad in terms of PM2.5. Pollution wise, gas is better as it is a cleaner burn, but Australia’s oligarchy is ensuring that gas is unaffordable and we pollute our suburbs.

If you want to know how bad wood fire heating is, then Armidale is pretty polluted in winter and there is an increase in respiratory issues.

Don’t most people just use reverse cycle air con to heat

australians wouldnt need to rely on any heating measure anywherre near as much if our houses were actually built to passively retain warmth in winter. they are absolutely horrendously constructed heat sinks that leak warmth – in my apartment when i put my hand up to the closed window sill or doorway i can feel the freezing air seeping in.

its not feasible for anyone to afford basic things like double glazing (let alone triple or above) here, if there are any builders that even offer those features, let alone properly insulted ceilings, floors, etc.

not only do we have the most expensive houses we have the worst constructed houses. i’ve heard of people from finland coming here in winter and complaining about how cold it gets indoors.

EZFKA golden rule you don’t get what you paid for.

Mates wife is an eskimo and complained their ACT abode was freezing. On a visit I noticed she had heat shrink some kinda plastic to the inside of the window reveal. Apparently some kinda make shift double glazing. Looked interesting to say the least

Seems purely aesthetic.

I like wood smoke. But I like sulphur too.

Parent’s old place used to have a wood fired incinerator – IIRC use was banned in the early 90s, and can remember the smell was always foul.

On the otherhand, love the smell of wood campfires although it’s only something we do once a year at most.

True, Its worse because it’s worse.

https://en.wikipedia.org/wiki/Pea_soup_fog

RBA likes to jawbone too

apart from admitting he has no idea what’s going on and no way to affect it, the admission here is quite stunning :

wages must always rise less than inflation

(otherwise our masters might lose a tiny bit of wealth )

this does not bode well for the possibility of inflating the mug punters’ debts away….

Yes, but it’s because it’s in the hands of the government, not because Phil is in charge of anything

It’s interest rates that respond mechanistically

Chalmers and Lowe are obviously “our guys”

Both chalmers and lowe want to avoid significant wage rises.

because significant wage rises will require interest rates be hiked further than they otherwise might.

and this will crater the EZFKA housing trade and be terrible for the banks, like I keep telling you

And there’s nothing Phillip Lowe can do about it other than jawbone and propagandise

well, he could not put up interest rates and look through the inflation…

Or kill workers’ ability to negotiate a wage rise by causing a spike in the unemployment rate.

That won’t happen just because Lowe wills it

It will happen with a recession caused by rising rates. This is the objective.

but rising rates won’t cause a recession, they don’t cause anything, I’ve been assured. because reasons…

rates will be rising because wages are going up and so is inflation

He is purely a passenger/witness, is my point

All he can do is produce propaganda and give an illusion of control

Falling real wages isn’t going to boost housing…

Wages rising nominally (say 3% pa) while going backwards in real terms (say inflation at 4%pa), with mortgage rates at 6%

is much preferable (politically) to

wages rising in real terms (say 6%pa) while inflation is at 5% with mortgage rates at 8% (as rates have been hiked by RBA to try to stop inflation)

because 8% mortgage rates destroy housing

home Ownership is at 63% now

has been falling for a while

what happens when we get to 50%?

actually probably doesn’t even need to be that low, because it’s from census data of HOUSEHOLDS so probably a lot of adult children living at home with parents, and a lot of rental share houses skewing the numbers

they would all be happy with a house price crash

and the % of people with significant holdings of bank shares is probably already much less than 50%

imo it probably already isn’t politically untenable in terms of the electorate, only in terms of the donors

Why? It most likely doesn’t make housing any more affordable. Unless the crash is caused by an explosion of supply it is caused by reduced ability to fund the purchase and the same people will still miss out.

From an accommodation perspective – the same number of people miss out, but not all the same people.

from an ownership perspective, there could be a significant conversion of renters to owners, too. Under certain conditions.

I’m really struggling to come up with anything that reduces purchasing power of existing buyers but doesn’t also reduce purchasing power of those currently priced out. Maybe some really insane government manipulation, but I can’t imagine what. FHB Grants just push up prices with the same people actually buying and missing out.

I guess There’d be some folks out there with large deposits who shied away from large debt loads & were always outbid by people with 5% down and fake incomes.

so there could be a rotation between those cohorts.

but this is at the margins.

shaking investors out of the market would probably be a more significant mechanism, if that were to happen

still, as you say, and as The Claw has taught us – physical shortage is a significant underlying problem. This would need to be solved by a bowel-shaking recession that prompts massive emigration.

mortgage rates at 8% guarantees that wages aren’t at 6% and inflation at 5%. The economy will implode long before that.

Is not getting re-elected preferable politically? Because falling real wages virtually guarantees it. political instability is the inevitable result of falling living standards.

“wages rising in real terms (say 6%pa) while inflation is at 5% with mortgage rates at 8% (as rates have been hiked by RBA to try to stop inflation)”

Then central bank independence must be done away with.

Anyone else would do the same. or similar.

nobody can really be trusted with the magic money tree, to use the money tree for “social good”.

Because people are corruptible.

And because there is no one such thing as the social good. There are only competing interests. …At least in the EZFKA.

I think the point he’s making is that changing the RBA’s mandate or management could remove the rates at 8% part of the equation. It still won’t magically fix stuff just change the tradeoffs made and the resultant winners and losers.

The only way that the debt can be inflated away is by ignoring inflation when setting interest rates.

yeha.

But, incidentally, this is also only appears possible if some regulator (central bank, or another bit of government, whatever) forces the rates to be lower than inflation.

without such an external compulsion, there is hardly any way that banks will keep rates below 5%, when inflation is 5%…

Yes, but if competing interests get a go at the money tree perhaps this will result in a kind of long term homeostatic operation, instead of never ending banksterism.

Very good point!

Basically what the MMT proponents want

do away with central banks and government bond issuance

Unemployment ? Print money

Inflation? Raise taxes

the Central banks and govts cooperated to do the first part quite well

now that it’s time to do the second part, they’re pointing fingers at each other

at least if we did away with central banks there would be no one else for the government to blame , and it might be more likely to get done

It bodes even less well for a 2 term labor gov.

Ruling over falling living standards is a virtual guarantee of getting booted at the next election, and falls in real wages is exactly that.

Lowe would have been hoping for early 2000s scenario of manageable inflation and wages rising slightly faster.

lamp post him.

Wasn’t it the libs pulling this get tough schtick that resulted in the legislation that has achieved exactly zero to date?

Expect the same from labor is my guess. All blow hard, no tangible results.

Why try too hard when you can get a lucrative board position post political retirement? The elites look after each other.

gutless arses won’t antagonise the cartel…not happening

Albo should ask his beard to have a word to the cartel because she’ll be more useful than him

I guess they will fall in line, otherwise they will have to *ahem* face the Husic.

Only in America

Olaf Scholz , in an interview with the newspaper Munchner Merkur, fired several deep thoughts, the concluding one being :

Putin “seems afraid that the spark of democracy could spread to his country”

and thus has been “pursuing a policy aimed at dissolving NATO and the EU.”

Russian Foreign Ministry spokeswoman Maria Zakharova, returned the fire:

“A couple of times German sparks spread to us. We will not allow any more

fires.”

Rule number 1, don’t mention the war.

https://www.afr.com/policy/economy/the-reserve-bank-s-plunge-into-negative-equity-20220619-p5auvi

i copy pasted the choice bits but it’s “awaiting approval”

so maybe peachy can do the needful

but it’s the AFR getting crotchety about this hippity-hoppity newfangled MMT stuff

Has anyone else noticed how nicely behaved winning@failing is over at the MB comments compared to his potty mouth over here?

I don’t look at MB anymore, they became irrelevant.

Yep , hooray for this place. MB is a knitting club.

Hah! DLS lets that inbred retard post but keeps Peachy and myself locked out…. what a joke.

inbred retards just believe you no matter how retarded the garbage you write is.

Leitho is sweating those interest rate increases. Maybe ask DLS for a pay rise.

OT: Just remembering when Paul Krugman asked for evidence that inflation was bad for poor people and on the same day Jen Psaki tried to say inflation was good for the poor.

They tried to push that for about a day before giving up.

What these neo-liberals really want is complete technocratic control. An economy with no morals e.g. they can inflate away the savings of a retired labourer if they consider the world “awash in savings” or leave generations locked out of home ownership and stable work, depriving them of the foundations needed for a family and a happy life.

Closer to home we have the clown “progressives” like Greg Jericho et al. pushing the same thing. They’re more concerned about trans issues and climate change than real economic issues that are destroying the working class right now.

another two for the guillotine

As fixed mortgages end and rates rise, many risk losing their homes – ABC News

Some interesting points on first couple:

This couple would likely have a maximum saving capacity of $50k-$70k (including the money they have saved on rent). An OCR of 3% would result in a variable rate of 5%, and interest-only payments would exceed $70k pa.

A 3% OCR is going to put a whole lot of mortgages in arrears. As has happened for the last 20 years, the banks will be happy to extend and pretend until equity dries up. I believe the sliding scale will be:

scamscheme to these buyersreality is that the ibrahims will be able to hold on easily. They would be grossing at least $150k each, $300k for the household.

thats over $200k after tax.

so $70k of interest only (or $95k P&I) repayments will bleed them pretty hard, sure, but they’ll be able to hold on.

now, what’s the likelihood that once the rates are at 5%, some other clowns will come along and sign up for $95kpa repayment for the same house?

Rather low, I reckon. Price will have to adjust somewhat.

I didn’t see the bit about the lawyer. Her story is bs then as there is no way they were buying second-hand clothes and still taking years to save $160k.

How much avo toast were they consuming

but seriously white collar professionals in Sydney in their 30s $150k would be the absolute minimum they’d be making ime

Yeh, it’s probably BS about the sacrifices they have needed to make.

what’s not BS is that lawyers are typically fucking awful with money & finance