There is stupid, and then there is this!

The dopey morons over at FINA seem to have trouble distinguishing between a good idea and a complete floater!

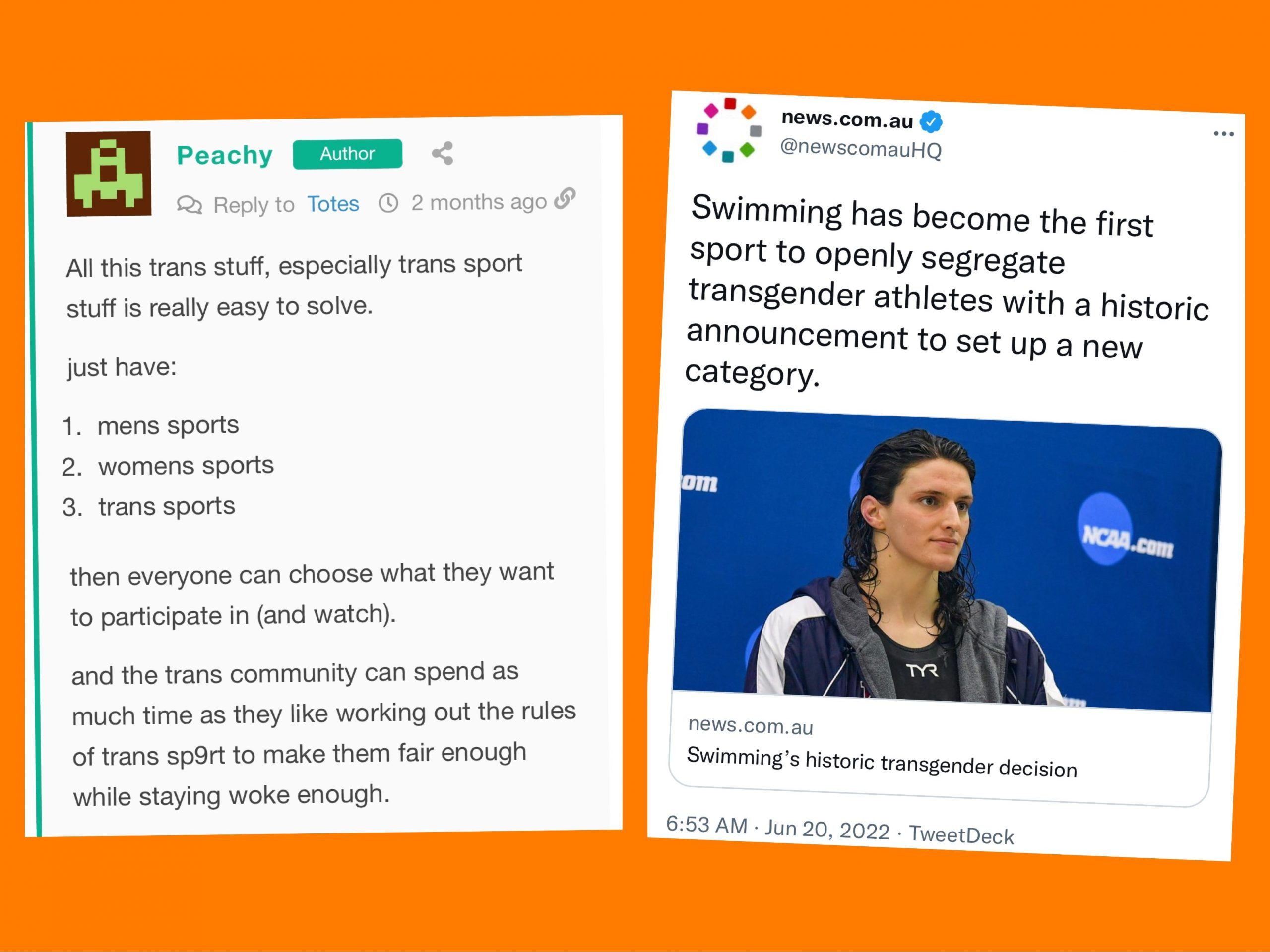

they can rely on the popularity of the transsexual event being eclipsed only by the regional lawn-bowling quarter finals. Will be interesting to see how long they persist in this endeavour, sans audiences.

https://www.smh.com.au/politics/victoria/gladys-liu-eyes-seat-in-victorian-parliament-20220620-p5av45.html

can’t seem to get rid of this bitch

Kind of like the yellow kristina keneally

victorian stuck between scylla and charybdis

also check out the photo of the reporter producing this article

What’s the point in Victoria? Don’t the Chinese already own the majority of parliament?

Haven’t they added a few more letters and numbers to their alphabet lately 🤔

I think after the first 3 or 4 letters, everyone stops paying attention, so they can add as much as they like, nobody gives a damn anymore. 🤪

That’s the idea – won’t be long before they add a “P”

😯

And plus signs too.

honestly, does anyone really care what happens to sports? especially women’s sports

Nobody watches it

Nobody cares who wins

Women’s sports was a virtue signalling exercise from its inception, like disabled games

its boring as fucking bat shit, ESPECIALLY swimming

and the trans stuff is just another distraction from the ongoing loss of our freedoms and financial opportunity

I certainly couldn’t give a damn about sports, but it will be sweet to see them flounder and sink (haw haw) with their she-man swimming idea.

https://m.youtube.com/watch?v=qgSzGIkFq2A

FFW to time mark 0:50

1984 touched on this nicely

Keep the proletariat busy with alcohol, gambling, gossip, sports..

Of course it is a distraction. Bread and circuses to keep the masses occupied.

I care. I have a daughter and I also believe that playing a sport is an important part of being able to live a full filling life.

Not everyone enjoys playing sport, but for those that do it is important that they have access to both sporting facilities and competitions that are fair and safe.

Allowing big boofy poofs to identify as women and then physically play against natural born women is wrong.

As for watching sport – frankly I find all sport incredibly boring to watch, televised sport as it is promoted and distributed, is little more than ‘bread & circuses’ used to distract the plebian masses from more important things they should be paying attention to.

In terms of remuneration I am probably in agreement with you. Professional sports, male, female and now trans, should only be paid according to the market value that selling televised spectator events generates. The idea that top level sportwomen should be paid the same as top level sportsmen, when no one – especially women – watches professional women’s sport is wrong, demeaning and backward.

Stewie says that de-sexing even 80% or 90% of the males does not endanger the population growth.

because the remaining 10%-20% can still service all the mares. Easily.

it’s if the jibby-jab screw up a lot off the females (say the same 80%), that population would crash.

this makes quite a lot of sense to me.

mind, if all this is true – the global south population (Africa, etc, largely unjabbed) will boom while the west (largely jabbed) will disappear

maybe that is the end game, to have the new subjects with little experience of the Westworld’s wicked ways and insuficcient know-how to escape it?

~¤~¤~¤~

Ruskies whom are losing in Ukraina but somehow won the WW2 at the cost of lives of the whole Australian population in the year 2025. (27mil, mostly men), struggled for generations to repopulate. First hand anecdotes say that women shared their toxic males with friends in a village far enough to be able to produce an offspring. Similar story with rare history titbit in Serbia (WW1) losing approx 58% males and never recovered (100 years later population is not even 2x the 1914. levels).

If we talk of Platy fish, I had 1 male and 3 females. Within 3 months there were 100+ and I gave them all but some babies crept out from plants and rocks and within 4½ months there were 150 swimming again. I had someone take them all about a month ago, she picked everything that moved inside aquarium. 3 days later I saw the little fluckers swim again.

1% of toxic males can repopulate entire planet but whom will support the offspring for the first 2 generations? There is more to human repopulation than the mere sperm count and number of coituses.

The Russian peacekeepers are winning

The six year war of the Triple Alliance in Paraguay killed around 2/3’rds of Paraguay’s population and 90% of men.

Not for sure. Women are easily capable of having 5 times as many children as they currently do in the west, even 10 times.

1 child a year for 20+ years is easily doable.

😮

Maybe not easily, lol.

Just thinking through this – and discounting to 10 kids per female rather than 20: there would be quite an issue with raising them (having delivered them).

seems like the state would have to step in to support the raising.

Or, in other words and considering the scale at which this would happen, to usurp the raising.

This could be the cultural holocaust/replacement concern that we’ve previously discussed here (in the context of Marxism, but).

could be like Huxley’s Brave New World, which explores the replacement of families by state…

https://qz.com/1099800/average-size-of-a-us-family-from-1850-to-the-present/

It would seem in the 1850’s a 40yo women was almost as likely to have 9+ of her children living with her as 1 or 2.

Whether these children need to be raised by the remaining 10% fertile women or are spread across the whole population is an interesting discussion but the reality is our current society is deliberately crushing fertility rates of women compared to the natural rate.

Some interesting charts there.

tjere is a lot of time separating 1850s and 2020s and a lot of structural differences.

so while acknowledging that 5,6,…9 children was reasonably commonplace at the earlier time (perhaps in a homestead on a farm), this doesn’t really say that it is practicable now (in a hyper urbanised locale).

there would need to be a lot of societal change to accommodate 6+ child families becoming commonplace. Exactly what that might look like is hard to tell, but the very point is that it would create significant cultural upheaval (if not outright holocaust)

not necessarily.

rasing multiple generations of kids is actually a shared activity. By the time my grandma gave birth to her 8th surviving kid, the eldest was 18 and about half were old enough to care for everyone younger. Kids in a pack of staggered generations are easier to upbring.

the problem is food. My grandpa had enough land for everyone to do their contribution bit and all would be fed. remove grandpa and/or land and the story changes to a nightmare.

this is why a family need a male and a female with split and shared responsibilities to rear children. everyone does their bit and everyone grows to be a happy Larry.

IMO single parents cannot rear more than 1, perhaps 2 without a heavy toll on a parent.

That is true, as I mentioned below the War of the Triple Alliance in South America resulted in Paraguay losing 90% of its male population:

https://www.theguardian.com/world/2020/feb/27/paraguay-war-of-the-triple-alliance-anniversary

However, such outcomes come at a great social cost – such societies are far more unstable, the role of women is severely downgraded in those societies, as women compete for mates (where the males have been killed off) or where males compete for women, where social customs allow wealthy older men to collect multiple wives…. societies of the later, where men horde available women, also tend to be higher in terms of institutionalized pedophilia – bacha bazi boys.

In regards to Paraguay, losing 90% of its men resulted in the development of a particularily strong and virulent form of Latin American “machismo” culture and resulting gender violence:

Such societies where there is anything other than a broad opportunity of a 1-to-1 mating relationship, are unstable unpleasant places that you would generally not want to live.

This is extensively described in incel theory

Still waiting for your article, co-authored with stagmal!

Very good article! For all your finance needs plz visit my website, International Binking.

Binking, huh?

sounds legit…

Yes we are very respected International Bink.

What kind of Binking do you provide?

International, obviously…

Touché

Yes Sir we are the leaders in International Binking

InternationalBinking.com

https://www.linkedin.com/company/shanghai-binking-international-steel-co-ltd

Good morning Sir, we are an International Bink who can provide all your Binking needs. We are not involved manufacture but can provide capital these ventures.

Hello friend! ARe you know Mawai Ndou-Postoffilos?

He may need finance for a goat.

Good morning, as we are in business of Binking (International) we can provide for livestock purchase. I am not familary with Post office person sorry

Sir, I was part way through submitting an inquiry on your website, but the website went down and is now no longer working.

could you please advise when I can access the website again?

Good morning, are website is down for maintenance due to Putins war/ wheat shortage/inflation supply chain.

Rest assured your $$$ is safe with us.

We are backed by CommBink, Australias largest Bink

perhaps this is the cul-de-sac that this has to go to expose its own absurdity.

We do not have the same issue with women decorating as men participating in male sports for obvious reasons hence the obviousness of the stupidity of the men decorating as women participating in female sports.

The absurdity and auto-goal for the wicked ways of WEF and leftards is required. I think this is a brilliant move by FINA not to offend anyone but to protect women’s sports.

Plus they’ll be demanding equal money as if anybody cares about this freak show.

Sponsorship and government money pay for sports. Fan money ie people watching is hardly relevant. My wife went to the tennis several years ago. One of the top seeded women’s match had far less spectators than a top seeded man on the same night. Yet they both get paid the same. Equal pay across all will be a given.

Except for that whole sponsorship thingy being dependent on it.

There’s a reason the male football leagues get far more money for TV rights and sponsorships than the womens.

equally, womens beach volleyball seems to be more popular than mens indoor variety.

The Reserve Bank has conceded that the disorderly end of its yield curve control policy in November last year caused market volatility and dislocation, inflicting “some reputational damage on to the bank.“

That is one of the conclusions in a lengthy review into the YCC policy enacted in March 2020 at the height of the pandemic-induced market. The policy involved pegging the three-year bond rate to the cash rate with the intention of lowering interest rates and providing assurances that rates would not be increased.

The target held until late 2021 when the market selling pressure forced the central bank to drop the peg.

Here is a summary of the findings published this morning. Reserve Bank governor Philip Lowe will discuss them in a speech titled Inflation and Monetary Policy –at the AMCHAM event co-hosted by ANZ at 10am.

this is all that he needs to have said. This explains over a decade of RBA acrions

Sounds like they’re going to back away from QE too

this inflation episode which was actually all about russia and supply chain issues, has all been blamed on the poor central banks

I get the feeling that’s the case in the US for sure

and why they are now hiking rates into a recession , so they can be seen as doing something

very interesting imo as it’s less likely they will try any more financial chicanery in the future

a good part of this rhetoric is them pulling their horns in and acting all contemplative ahead of the external review.

it’s too early for them to tell whether the “review” will have a hidden agenda of some sort (in my mind – likely to promote moar easy money for the right sort of people) so it makes sense for them to assume this kind of stance, which will be largely compatible with any outcome.

as to the broader goings on in monetary- and interest rate-land, I do think that, inwardly, RBA would consider a 3.5% (or whatever) OCR as an unlikely outcome.

but outwardly they must appear committed (ie pre-committed) and represent a credible threat. They need people to act on the basis of the expectation that this is where rates are going.

if something breaks and demand destruction occurs well before 3.5%, they’ll throttle back.

it’s basically the same mechanism that explains the “no rate rises until 2025” thing. They needed people to act on that expectation. When they no longer needed people to act on that expectation, they changed the narrative and delivered rate hikes to make the new narrative credible/demonstrate commitment.

well that’s the theory of jeff snider etc

the central banks don’t actually have any power over money creation, and QE doesn’t actually do anything, and markets set rates not banks

They manage psychology instead, by appearing omnipotent

They can achieve this by admittting they messed up (ie they’re too powerful)

Need to consider though that this is a double edged sword

as they will be blamed if things go wrong even if it had nothing to do with them (like now)

Its a political issue, as you see Biden throwing JPowell under the bus, and forcing Yellen to come out and “admit” that the fed fucked up

it will be harder for them to lower rates again, and engage in QE in the future

Not impossible. But harder

I don’t know who snider is. But I think he is wrong that the central banks don’t have any power.

they are not omnipotent, but they are very powerful. The words “don’t fight the Fed” are written in blood.

that’s just part of the job. Taking the flak and the blame for politically unpleasant outcomes.

incidentally, it’s probably a good part of the reason why central banks are “independent”, shielding the government executive/administration

the belief is that its a self-fulfilling prophecy

It is clearly more than just a self fulfilling prophecy.

“the market” is relatively big as well and more than capable of calling bluffs or threats that are not backed up by ability and willingness to act.

so the central banks are clearly not impotent. As I say – don’t fight the fed is written in blood.

“the market” is largely psychology

even if you were aware it was all bluster, knowing that other people do not realise this, it makes sense to buy

and then knowing that other smart people know this, makes it even more sensible to buy

You just need to look at long bond yields over the last decade (up until this year) to realise that bond traders don’t think that central banks are potent

something like that – george soros calls it “reflexivity”

https://www.youtube.com/watch?v=IUIOP7NPySY

This was an amusing recent one where jeff snider outlines his takes

Not saying he is correct, but there are a lot of contradicitions in the mainstream interpretation that he does highlight

That’s more a judgement that QE does not cause CPI inflation to any great degree.

ok

but that is kind of the point

there’s no proof that QE causes much of anything, including inflation

In spite of this, the central banks and QE are being blamed for everything, especially inflation

This will prevent/dissuade them from doing more QE in the future, regardless of whether QE actually is money printing or causes inflation

Because it will be politically untenable

I think we’ve been over this before. There’s plenty of proof that QE juices asset markets. If you don’t want to call it inflation that’s fine, but to argue it doesn’t cause much of anything requires ignoring a lot of evidence.

We’re seeing what happens when they unwind QE; liquidity vanishes and so does the bid.

The Fed’s Waller said a couple of days ago that even in a typical recession there’s a decent chance the Fed will need to cut to zero and buy bonds.

They will never stop brrring. The only way to stop them is to change their mandate.

high asset prices were simply a function of PE multiples and low rates

and rates were low because of lack of growth

the low rates were due to lack of growth prospects which was due to fiscal austerity and wealth inequality (eg a failure of governments)

there’s plenty of papers that attempted to determine the effects of QE on rates , and its <0.5%

rates fell BEFORE the fed started qe

And they rose BEFORE fed finished qe

but the psychological operation did give people confidence to buy assets , and borrow money to do so, which due to reflexivity led to money supply growth

for a time

Here’s another curious quote from today

https://www.wsj.com/amp/articles/feds-bullard-says-he-expects-economic-expansion-to-continue-this-year-11655743500

is the tail wagging the dog here?

but the dog still needs to maintain the illusion of control

it’s not the tail wagging the dog. it’s perfectly natural:

Dad says: brace yourself son, I’m going to belt ya.

Son: *duly braces himself*

the son isn’t in control

Not sure what you’re saying and perhaps I shouldn’t have made the analogy

the fed doesn’t really have control of anything is my point

they just need to maintain the illusion that they do

its a confidence game

What’s not to get here?

let me make it more overt…

FED says: brace yourself market, I’m going to belt ya.

Market: *duly braces itself*

FED: *duly wallops market*

the market isn’t in control here.

And if that’s not enough, even more overt…

just because the bracing is consistent with the being belted doesn’t mean that the bracing causes^ the belting.

that be cargo-cult thinking – that building things that look like runways and air traffic control towers makes planes with cargo-bearing appear from nowhere….

from my recollection of events, you have it completely backwards

first, the fed told markets that rates would stay low until 2024

then the markets went “yeah, nah don’t think so”

then the fed went “oh yeah, nah, that’s what we meant”

then the fed quickly scurried to quickly catch up to where markets were at

in Australia, captain phil said “we are doing YCC and rates won’t rise until 2024”

then the market went “yeah, nah, you aren’t doing YCC and rates will rise right now and continue doing so”

and captain phil went “oh yeah, nah, that’s what we meant”

and captain phil very abruptly ditched YCC and went from promising all the FHBs low rates for years, to jacking up rates and warning everyone they were going to keep going up

You remember hopefully that chart I posted that shows that the RBA overnight rate exactly lags the 2yr by 3-4 months?

Yeah, it isn’t the RBA in control

But they have been very effective in convincing you that they are

This sounds bizarre because its a face saving manouevre – “yes, this is exactly what we intended. It’s all going exactly as we had planned”

i have dealt with this above:

your examples are all examples of reserve banks’ willingness to act being way behind it’s rhetoric. The bLuff was called.

rba could’ve persisted with low rates and ycc, using infinite AUD. Could have. but ultimately chose not to, as the various costs of doing so were escalated. The bluff was called.

BoJ is trying a different tack… or maybe they are just bluffing for longer.

BoJ is a great example

no inflation after 20 years of their QE and YCC

Then suddenly with a war in Russia causing fuel and agricultural shortages, and covid lockdowns causing manufacturing shortages

They suddenly have inflation

and you want to blame central banks?

I’m not sure what you think “calling their bluff” means

to me it implies the fed believes it can dictate to the market what rates and inflation will be

“Calling their bluff” implies that they are bluffing – ie they don’t set rates or inflation, and they aren’t omnipotent

they can do all sorts of wacky engineering, but none of it results in money being created

There is about half a dozen mixed ideas in the above. Eg:

Ok let’s play

if you define inflation as asset price inflation , then why did japan and USA/AUS have such wildly different results , despite all running the same government bond buying operation ?

if you define inflation as CPI inflation , then why did NONE of these places have any for years or decades despite all running the sake government bond buying operation ?

does it not suggest to you that there are far more important factors / differences at play ?

I’m tired, it’s past my bedtime.

its your job to define inflation, not mine. On account of you’re advancing some sort of thesis or argument…. I think?

as to the examples you point to wrt to asset price growth and CPI price growth, I don’t see anything peculiar there.

if new money is pumped into assets, asset prices grow (or assets are more scarce, relative to money, or money is devalued against assets).

If cpi-type goods grow more scarce relative to money, then you get cpi price growth.

of course you can have the former and not the latter for as long as China (or whoever) is supplying you with shitloads of consumer goods (ie coi-type goods) and dirt cheap prices, with cheap delivery. If that dynamic is interrupted, cpi-type goods grow more scarce relative to money. This ties into the “regional differences” I alluded to earlier – https://www.ezfka.com/2022/06/20/fina-fools-pick-up-preposterous-peachy-proposal/#comment-24563

If I had a cargo plane I’d land there!

I appreciate that, Harry!

If money for QE comes from bank reserves, then isn’t QE an indirect reduction of the reserve requirement? More leverage in the system?

but banks are not reserve constrained, they are constrained by lack of eligible borrowers

US system no longer has reserve constraint for a few years now, and australia never had one

Even previously in the US, banks could always obtain reserves through repo if need be

The loans would still be profitable

but QE does lower rates, which does encourage borrowing

That is not the point that I am arguing. There is money somewhere in the system that isn’t being lent out. The central bank grabs hold of that money and starts buying bonds. This is an injection of liquidity into the system that reduces rates on those bonds. With bond rates lowered it enables CBs to lower the OCR without the risk of deposit holders withdrawing money and chasing yield in bonds.

Snider makes a valid argument that there is a limit to QE (amount of money CBs can get their hands on). But I don’t believe it is a valid argument that QE or QT does nothing to effect interest rates.

Not sure what you are saying

money isn’t lent out. Money is created ex nihilo when a loan is initiated

I don’t think anyone disputes that central bank can set overnight rates at whatevver it likes, but they can’t affect long rates (even the 2yr as the RBA found out)

anyway, I don’t have my own opinion i’m just outlining the argument

Isn’t QE just directly buying to effect those rates? Clearly they weren’t motivated enough since unlimited money really does allow unlimited manipulation.

As you say, it’s a political issue. The next person appointed by the government will do whatever suits the government that appoints them. lower rates, QE whatever.

And if/when it blows up they will be expected to take the blame. That’s how “independent” bodies work.

Inflation in the US was 8% in January. Russia is not to blame. It might exacerbate it.

what about supply chains?

you know the whole covid thing?

I don’t know many people who have more money than they did last year

Wage growth is <3%

So why would it be anything other than russia and china and supply chains?

Fed has been doing QE for 10 years now. Why did it suddenly create inflation?

I guess it comes down to is inflation the same everywhere that is dependent on the supply chains? Is Australia experiencing the same level of inflation as the US?

QE has been constantly creating inflation in the asset markets that have been the target of the money.

Inflation out in the real economy is likely the result of injecting money into the real economy, so not QE but various covid stimulus and relief programs are a far more likely culprit.

The FED does Inflation like the old going broke saying ….

What do you reckon is more likely

-QE after 10 years in the USA , and 20 years in Japan, suddenly reached a critical level where it became effective in achieving inflation (after decade(s) of failure)

or

-the largest globally coordinated supply chain, social and economic disruption in history caused inflation

Old mate sits at the pokie machine feeding it 🍍 after 🍍 yet nothing seems to happen.

Old granny comes along and slips a five in and what do ya know the jackpot goes off…..can’t have one without the other.

and so the whole covid and russian embargo thing was just a coincidence?

russia is clearly really important to the global economy. it goes to show you when you boil it down no matter what bullshit like GDP figures say cold hard commodities regardless of what dollar value you stick on them like wood, wheat, oil, potatoes and steel are way way more important than dick pic social media apps and microchips so people can have phones that use dick pick social media apps.

nothing exposes the farce of gdp and “value” than the huge impact the russia sanctions are having on the world. an iphone or a netflix subscription adds more to GDP than a potato or a steel girder but at the end of the day which one is more fkn important lmao.

those who wondered whether the soviet union was really a superpower just have to look at the current situation to know why it was, and why it probably would have defeated the west in any long-term war. it may not have had fancy kitchen gadgets but it was a super producer in the fundamentals of life.

Top post

what she said 👆

my thoughts echo your post, whenever the AUD pops into my mind….

a fkn quarry shithole supports this inflated ezfka currency

No, it was just a little bit of history rhyming

They came out with their 40 year high inflation of 8% in January. I don’t see how they can pin their mismanagement of their economy on Putin. The war didn’t begin until late February.

Inflation is virtually the same as it was in January.

Of course supply chains are a problem, but China holds the whip hand here, they are controlling the price of manufactured goods like say Saudi Arabia would control the price of oil by restricting supply. It’s quite ingenious.

The west has to sit and take it now because they farmed out all their manufacturing to the much smarter, much more cunning Chinese.

lockdowns and disruption started in 2020, effects were felt shortly after

Russia and oil/ fertiliser just added to the problem

why are you completely ignoring 10-20 years of complete absence of any detected inflation with QE ?

Because the relevant question is would there have been deflation without it, if you want to know if it had an effect or not.

But as usual you are far more interested in pretty theories than any actual evidence of anything.

It can dictate what rates OR inflation will be, to varying effectiveness because all this stuff is interconnected. Claiming they can’t control anything because they can’t control everything is a very lazy argument.

https://www.spiked-online.com/2022/04/23/how-the-trans-ideology-dehumanises-women/

I often forget that a big chunk of the activist trans community are mentally ill. It makes sense when you consider just how counterproductive most of their activism is.

They’re mentally ill people being indulged rather than receiving the treatment or reality check they need.

I suspect most of them post 40 transition back to men or kill themselves.

That is one rather terse book review!

A big chunk? Being trans is a mental illness by definition. They’re all stark raving mad, evey last one of them

The sickest part is when they claim these mental issues are caused by “us” not accepting “them”, and then they shove trans culture down our throats as if that will suddenly make them normal, happy people.

Yes.

I think very few people would mind if sick people (or even healthy people) felt better about themselves after putting on makeup or clothes usually worn by the opposite sex.

but insisting on pushing this in peoples faces and down their throats… and down their kids throats and trying to subvert language with shit like “girl dicks” – that seems to cross a line.

https://www.dailymail.co.uk/news/article-10936571/Daniel-Andrews-introduces-LAW-schools-teach-students-white-colonisation.html

Culture war intensifies