It has been a while since I’ve done a post and a lot has happened since the last one I did on crypto back before Christmas “Crypto Lending and why you should stay the fuck away from it…” (I’ve opened it back up if anyone wants to take another look).

Taking a look at what I wrote it is amusing to see how accurate my prediction was especially in regards to Celsius (even if the timing was a little off in that it took a little longer than I thought). The biggest flaw was the needless and possibly confusing explanation of backwardation and Contango. I only included it as an example of a risky trading strategy that traders were engaging in as an example of how the system could break, and break it did.

As it turns out the trigger wasn’t too far removed from that example. The implosion of ‘Three Arrows Capital’ once a leading light in terms of a crypto based hedge fund controlling some $18bn in ‘assets’, 3AC was as close to the ‘Establishment’ as crypto firms come, being around since 2012.

Essentially 3AC was one of the ‘greedy traders’ I was referring to in my first article (along with SBF and FXT who are also intimately involved in what is going on). Firstly 3AC was a huge investor in Terra and Luna, the algorithmically balanced stable coin that collapsed last month. Secondly it had placed some massive ‘arbitrage’ trades between ETH and stETH or ‘staked ETH’ which was Ether that had been staked into the new ETH2.0 pos system that is supposedly only 6mths away.

Theoretically ETH and stETH should eventually equal each other, as they are merged into one new chain, however a key difference exists one which anyone who works in Finance is acutely aware of and of which most people in crypto are completely unaware of – liquidity risk. This difference in liquidity between the two markets and the residual uncertainty that maybe ETH2.0 may never go ahead, meant that there was a slight difference between the prices – essentially the price gap vs the future expected merged price creates a short dated forward in stETH (forward price vs spot becomes an issue of Contango/Backwardation that I made a ham fisted job of using as an example in my post before Christmas).

The trade was borrowing ETH at around 2% and then doing a form of yield farming ending up going long stETH generating about 4% or so real yield. Literally picking up pennies in front of a steam roller.

Consequently traders like 3AC and FTX went tits long on this trade, with crypto lending firms like Celsius and BlockFi loaning them the fuck loads of ETH to do this trade. FTX is probably gunna get out of it okay, as they have the ability to sodomise their trader’s stop losses and clear them out, while trading against them from their unregulated exchanges based in the Bahamas. Twitter is currently full of FTX traders who’ve used any form of leverage being arse raped by Sam. However the issue presents a huge problem for 3AC who doesn’t have such nefarious means of making back their collateral.

Last month before Terra/Luna collapsed, 3AC had spent around $560m buying locked Luna (essentially Luna that was staked and locked in contract). That is now worth around $670 dollars, not millions of dollars, $670 actual dollars. Apparently 3AC had also invested a large portion of funds placed placed with it by investors into Terra and Luna secretly, as it did not have an investor mandate to invest those funds in the Terra ecosystem. Be prepared for the follow on as many local crypto funds are forced to reveal that they had placed their funds with 3AC and are now also looking at losses to explain to their investors.

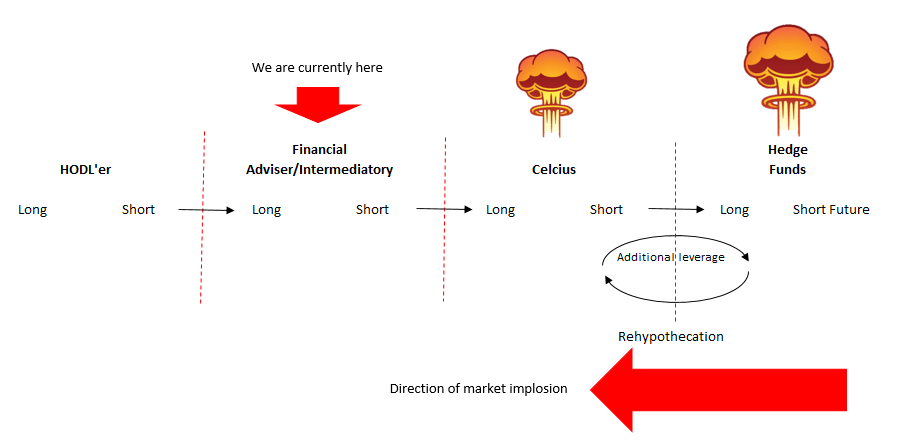

Re-using the diagram in my December piece, diagrammatically we are currently here, waiting for the 3rd stage bombs to go off:

When Terra and Luna collapsed it created seismic waves that rippled through crypto land – for a while it seemed as though things have quieted down, but the reality was it was like being in the eye of the cyclone. The quite respite, was actually the period of time when all the inter-dependencies were starting to break as the plumbing backed up throughout they system. This is the EXACT scenario that I described playing out in my article before Christmas.

Obviously 3AC is now in the poop. It is most likely insolvent, as are the crypto lending firms like Celsius and BlockFi who enabled these ridiculous trades. If this is the case then the likelihood is that there are a great many other firms who do business with them who are also likely insolvent.

Guys like Celsius operate a 10-20bn balance sheet with about 5% of equity buffer – they will have to eat 3AC’s losses, which will mean their equity effectively evaporates. Right now most people I’ve spoken to who’ve parked coins in Celsius or BlockFi are completely unable to access them – imho, like I alluded to in December, those coins are already gone.

So that brings us up to the moment and closes off the issues I raised back in December. Where too now?

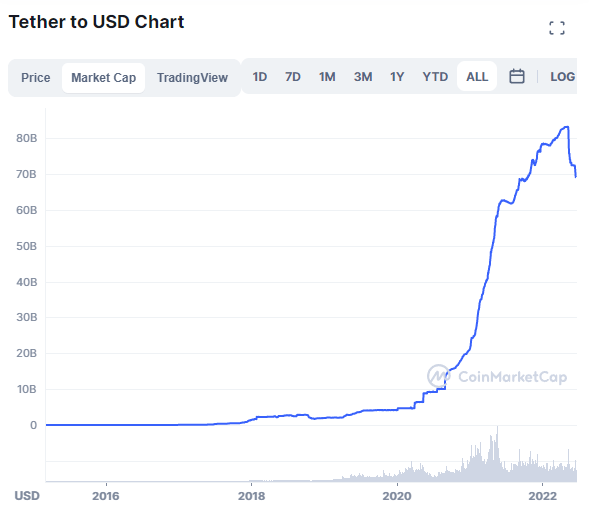

Well there is a chance that the market might muddle through it. This is a liquidity crisis and it is possible that crypto’s liquidity providers, FTX and ultimately Tether, might be able to pull a save off. Possible, but really given where the market is headed, with increased regulation and higher costs, are they really that incentivized to actually bother saving it?

Sam got Solana back up and over $150 around after Christmas, giving him plenty of time to sell down more of his stake in a flawed network that constantly goes down. Tether has been busy selling down its reserves as insiders cash out with the available hard currency, redeeming billions in the past month. Soon there won’t be any real USD left for them to cash out and they will have to start selling their commercial paper – which will imho turn out to be IOUs from Binance, Coinbase, Kraken and 3AC… good luck with that!

In all likelihood I think they know the party is over and aren’t gunna bother doing anything that is likely to cost them hard currency in order to assist or any actions that are likely to be scruitinised for their legality in the days to come.

So that means another prediction of mine is likely to soon come into play “The BitCoin Doomsday Machine… or why BTC could go back below $3k” (another article that I have re-opened, although alas, it is missing most of the JPEGs following the great flame war of 2021). Basically if the liquidity Doom loop that has been triggered by the collapse of Terra/Luna continues, then as the fall out continues to build the likelihood is that the price of BTC will fall below $20k and suddenly Michael Saylor and MicroStrategy and its enormous holding of BTC and the leverage it has used to acquire those long positions will come into play.

Saylor recently came out and said that MicroStrategy had the ability to add BTC from its existing holdings to its collateral requirements all the way down to a price of around $4k, so maybe the Doomsday Machine at the heart of Crypto might not go off…. but one thing I do know is that the market does have a tendency to eventually sniff out excessive and risky use of leverage, and drive prices down to the point that traders have no choice but puke up their position.

Having just liquidated my positions, I feel quite certain this is the bottom!

Thank you for your sacrifice Robert! It’s a dirty job but somebody has to do it.

stewie’s crypto articles are also typically published around crypto turning points, which also suggests that the bottom might be in for now.

😮 🤭

Very insightful piece. Where to now?

Hopefully 3ac and Celsius fall over and completely wipe out all investors. Need rubbish like that flushed out of the system.

with BTC, there is clearly a battle line drawn at $20k. Time will tell if it will hold. I think that there is a pretty good chance that it will.

more broadly, I think that the crypto space has now largely priced in a higher-interest rate environment, so should not be as affected by the next few months of rate hikes

So now you are expecting an “asset” that does nothing and returns no income to have “priced in” higher interest rates

honestly the dumbest thing I’ve read all day

it would be worth nothing, if not for the ample supply of stupidity in the world

it doesnt “price in” anything

its multiple ponzis and scams layered on top of each other like an onion

Celsius is just one of the rings

really shocking that someone like you, with a cynical world view, would think that crypto would be some kind of disruptor of finance and banking

it has some useful value I.e. in helping speed of funds transfer.

but to not see that it is a bare bone fiat with 0 backing other than the hype in trust/promissory… well, that indeed makes it a ponzi of the tallest order.

Stupidity has bestowed crypto with most of its value.

I agree with Coming. The whole thing is one big inbred fuckfest.

As I said, this is essentially a liquidity crisis within crypto – honestly not that too far removed from what happened in 2008. CDO’s and Yield Farming with locked coins, etc are not that far removed from each other, in that you are basically eating credit risk disguised as yield and the effectiviness of the natural arbitrage hedges across different asset classes only holds true when both markets are as liquid as each other.

In the 2008 crash the market was ‘saved’ by the liquidity providers i.e. Reserve Banks (mainly the Fed) coming in and saving the system, and to be frank imho that is the only thing that will stop the Doom loop in crypto – liquidity providers coming in and saving the system.

Who are the liquidity providers in crypto? Alameda Research (FTX and Sam) and Cumberland Capital (a group started by a trader who had been banned and fined by the SEC in US markets), neither of which are confidence inspiring in the best of circumstances. But the real liquidity provider behind both of them is Tether.

As I said above, given the redemptions occurring in Tether and their hesitation or incapability of turning the printers back on, it is highly doubtful imho that Alameda or Cumberland will be spending $1 of fiat to defend the crypto complex. There might be some more crypto chicanery and financial engineering to hold off the collapse off for a little while, but imho it will only slow or slightly delay the inevitable. Without the Tether printers being turned back on, I see BTC below $5k before I see it going above $50k.

IMHO the next points that you are likely to see stress emerge is in the crypto exchange space and the intermediaries that passed their customer’s coins on to Celsius and 3AC. The intermediaries are likely to experience their own liquidity issues as customers start wanting to pull back their BTC and crypto and those intermediaries they’ve lent it to find all the have to hand back to their customers are big IOUs from Celsius and BlockFi.

The exchanges are the interface between crypto and fiat, and they only have the ability to redeem funds to their customers equal to the amount of actual hard currency they posses. Selling BTC to raise cash is only passing-the-parcel to another exchange, so imho you will see a slow grind lower in price as true price discovery takes place until the next market disruption, probably caused by either big stop losses being hit or the next bit of the crypto plumbing backing up and exploding.

Then there is the 180,000 odd BTC that are going to be released by the MtGox liquidators, placing a huge amount of BTC back in the hands of people who have been effectively ‘hodling’ BTC since the price was less than $100….

Great article and commentary. As a non-participant but interested observer who has struggled to get their head around crypto in general, it’s been nice to read an accessible insight into the machinations of the crypto world operates.

Thanks – glad you found it interesting… better yet, glad I made it accessible.

I never got into crypto and has never interested me, but would you buy at some point? $100?

You can trade BTC at any price and attempt to make money.

Does BTC currently have some intrinsic value? I think it probably does, but only in the low thousands. Even what value it has is in its current network effect is likely to bleed away fairly quickly unless they can make it and the lightening network actually solve some problems other than allowing nerds to expensively pass magic beans to themselves.

If it fell to $100 tomorrow it would imho be through some catastrophic market over-reaction and Yes, I would probably buy it at $100, or even $1000 or possibly even $5000…. but I would be looking to sell it again after the bounce. I have no interest in the BTC vision of ‘digital gold’.

Woooow – just saw the BTC price!! Now less than $19k!!

Guess we’re gunna find out soon!

If it gets to $1000 that’s the perfect time for regulators to come in and crack down hard imo

They can credibly claim they are doing it to protect people from their own stupidity

but at the same time they can’t be blamed for crashing it, because it has already crashed

Which is probably their main concern (aside from the donations they receive from our Israeli friends )

and at that point the game is up imo,

if there is no more pumps and dumps , (and no money laundering) then there is no upside , since that removes the entire raison d’être

just a slow melt to irrelevance

of course the Israelis could keep the casino going with well placed donations to regulators in dubious jurisdictions , and it still shocks me the number of regular people who have been sucked into this so who knows

Yeah – I’ve long maintained that regulation will come AFTER the eventual bust. Indeed the conspiracy theory part of me has actually gotten to believe that one of the reasons the authorities have allowed the fraud to grow so large is that they both want to harshly regulate it and ensure that the idea of a public blockchain is so polluted or contaminated, that the public won’t oppose it being regulated and privatised until it is out of public sight…. even if it ends up being used everywhere, at all times.

Tether market cap has gone from $83bn to $68bn in the last few weeks

which implies that $15bn of real USD has been cashed out of the scam by the big players

and that must be most of the real liquidity since even tether co itself only claimed unaudited backing of 3% actual cash , and the rest “commercial paper” which we think is mostly a shell game of tether incoporationd in the BVI and caymans etc

even if it was legitimately $80bn of real but dubious quality corporate debt how much value has that lost from the recent bond market sell off ?

half ?

40 – 12 = 28bn left

They would have to be thinking now is the time to scalp what’s left from the carcass , as interest rates continue to rise and there’s an opportunity to buy real value assets at distressed prices

It isn’t possible to claim that the full $15bn by way of reduction in market capitalisation has been redeemed and pulled out via fiat or hard currency, although I would suggest that a good part of it has.

Its also possible that the reduced need for USDT liquidity as a result of the fall in the BTC price has allowed some exchanges to pay back the CP and IOU’s that they wrote when they were handed the USDT during the ‘pump’ part of the price phase.

Honestly I would be surprised if Tether had much more than $10 or 20bn in hard currency anywhere in the world.

It’s far far less than $10bn

Tether themselves released an “attestation” claiming only $4bn cash, so that is the absolute maximum value

https://assets.ctfassets.net/vyse88cgwfbl/1np5dpcwuHrWJ4AgUgI3Vn/e0dac722de3cea07766e05c52773748b/Tether_Assurance_Consolidated_Reserves_Report_2022-03-31__3_.pdf

I find it hard to believe that its even that much, nor do I believe that they have such large holdings of US treasuries

Nor is it clear what kind of “treasuries” they are. If they’re long maturity they’ve been slaughtered

And the “commercial paper” even more so

That wouldn’t surprise me.

I am significantly down on muh crypto over the last few months, yet I look at these events with glee and satisfaction.

they demonstrate that capitalism can actually work, unsustainable business models fall over… and make space for better ones to take their place.

yes, there’s a lot of collateral damage, but at least it works.

is it really a form or a branch of capitalism?

The net worth of intricate value as a service is infinitesimal in comparison to pricing. That should make it a mother of all ponzis and bubbles combined. perhaps bigger than the tulips.

I think you mean free markets rather than “capitalism”.

Free markets and capitalism both

In general it’s rare that people tend to openly talk about their losses, regardless of the investment class being discussed. I did wonder if the psychology with crypto is slightly different, as many participants have clearly given up on traditional investments either due to high entry costs or concerns about government interference.

We’ve already seen property investors and recent FHBs stung by rate rises blaming Phil Lowe for his comments about no rate rises until 2024 and all forms of government, but crypto appears for all intents and purposes to be unregulated, so there doesn’t seem to be any obvious scapegoats.

Yes, All our resident crypto shill retards have been deafeningly quiet last few weeks

hedge against inflation , I was told

Here’s a long discussion of the MSTR position

https://protos.com/explained-microstrategys-margin-call-math/

you see eth and Btc keep bouncing off the 1000/20,000 marks as they desperately waste what little real money is left in the system to hold off the big margin calls

I wish this turd would just fucking flush so we can all move on with our lives

what an absolutely retarded scam cryptocurrency was

peak clown world

this will have its own chapter in the history books , along with the scamdemic and the trans bullshit

only a hedge against hyperinflation, I think.

hedge against hyperinflation

More like a hedge against intelligence.

I wish there is a link for this interview with anglo titles, I guess this is by a design as in this interview he simply demolishes all the usual rubbish from the Westworld’s media/politicians.

Lavrov is essentially a politician but… Never mind if one agrees with him or not, Lavrov is a great orator, debater, statesman, you name it.

What interview?

https://m.youtube.com/watch?v=KIw5gnabMTM

it is a BBC interview by Rosenberg which cannot be found anywhere on BBC. I understand approx 2/3 of what he says and it is still profound

typing without glasses and with comment window constantly scrolling up an down during editing, obscuring parts of the comment (on the phone) makes it impossible to be aware if there are any problems like not bseevubg that the link was deleted during editing

It’s all Russian to me!

Here is the transcript.

http://thesaker.is/foreign-minister-sergey-lavrovs-interview-with-the-bbc-tv-channel-st-petersburg-june-16-2022/

Good read – no Fly’s original post makes more sense.

This is a legendary non sequitur.

fly is a really strange poster

https://mobile.twitter.com/BeachDog15/status/1518818029639020545?cxt=HHwWgsC98e289pMqAAAA

Good piece thanks.

FWIW, sold most of mine a few weeks back, only holding XMR now as it’s the only proven (for now) privacy coin and if it’s banned on Austrlaian exchanges and the crooks use it, as a general rule of thumb it has value.

Powell has point blank announced Fed coin by 2023 so you can see where it’s going. Whether they will be able to logisitically and practically force it we will see. So I don’t know whether crypto was one long data gathering exercise for fedcoin or this is an attempt to stamp out competition ahead of Fed coin.

https://www.pymnts.com/cbdc/2022/fed-chair-cbdc-could-preserve-dollars-standing/

Yeah that’s quite an interesting article – the possibility of fully transferable USDs in CBDC is one that many nations eg India, have already expressed fear over, as it will be very difficult for them to stop locals pricing and trading in USD denominated currency, completely sidestepping local authorities and meaning a loss of control over monetary policy by smaller nations (to the degree that local economic activity shifts to USD).

The fact that the USD and any CBDC that it eventually issues most likely won’t be on a public blockchain or a blockchain that is scrutinisable by the public, means that it will be very difficult for nations like India to catch people breaking any currency laws that they pass to try to ameliorate those effects.

Such an outcome is closer to the nightmare that Satoshi envisaged where if blockchain technology is not used on a publicly accessible ledger, then the technology will be truly sinister and enslaving.

I honestly don’t think Satoshi is a real person and rather a nom de plume for a group of people invol ed in blockchain development.

I would not be surprised if a central bank or Intel agency is responsible for blockchain. If I’m wrong then cool, but I doubt it on this one when you look as objectively as possible into the creation of blockchain especially the timeline. My 2 cents.

👆 indeed a very reasonable observation. Goggle too.

Nobody really wants to meet their heroes…

Relevant to the topic.

https://www.abc.net.au/news/science/2022-06-18/bitcoin-crypto-crash-and-celsius-freeze-affecting-australians/101157578

On popular Australian cryptocurrency Facebook groups, moderators have posted links to counselling hotlines. “There’s a lot of very distressed people,” said Luke Torsello, moderator of Crypto Australia Facebook group, with 99,000 members. “Everyone is in damage control at the moment.”

Lions eat antelopes. Welcome to the jungle.

It is like every other crash. Market has significant crash and media plays sob stories. I remember in 2000 when the market dropped and these day traders got slammed. The Courier Mail had stories about them losing money and they were losing sleep, giving up luxuries. They should have been bankers if they wanted government cash to bail them out.

Celsius CEO Alex Mashinsky

I don’t need to check his early life on Wiki.

This bloke’s got a hooter that could hoover up Fort Knox.

https://live-production.wcms.abc-cdn.net.au/26e7c00834b993bb1775a054736a1345?impolicy=wcms_crop_resize&cropH=3333&cropW=5000&xPos=0&yPos=0&width=862&height=575

The heuristic rules that stereotypes are an example of are again quite accurate in this situation. He is very much in with the Israeli mafia, many of his hirelings are Israeli, his now ex-CFO is also Israeli and now also before the courts. SBF has Israeli passports and despite how much money he donates to the Democrats and Uncle Biden, I fully expect him to end up fleeing to Israel once he becomes a person non-gratia in the Bahama’s.

https://larouchepub.com/pr/2022/20220617_petersburg_forum.html

Off topic… .good read

Indeed a very good read. So hard to get any discussion of Putin’s ideas, cultural values and global viewpoint in the West – everything about him in the Western msm is a ridiculous two dimensional villain.

Putin’s motivations in our media are only ever about ‘restoring Russia’ because he is ‘evil’ – there is never any analysis of his true motivation, that he see’s the West as filled by the hubris of its past successes and increasingly consumed by the mind virus of juicy progressive values which are being top down implemented and replacing traditional Christian secular values.

Putin, as a leader of a 1000 year old nation, also understands something that almost all the people living in the new Western nations, ergo the Anglo nations of Australia, US, NZ, Canada don’t understand – he knows that demographics is destiny. He’s accutely aware that if Russia hadn’t lost close to 30million people in WW2 as well as being spared the economic cost in yet another brother war inflicted by global bankers, Russia today would have another 100m people alive today.

Honestly imho his main goal is to broadly unit all Slavic people, who are all broadly culturally united under Russian Orthodox religion, and at the same time securing strategically important and defendable borders.

Other than that he knows that with time the policies that are being inflicted by our elites, such as mass migration and cultural obliteration, on the people and the culture who made the West the power that it is today (or was yesterday), will ensure their downfall and his (Russia’s) eventual victory tomorrow.

stewie how do we calculate the real electricity cost of Bitcoin mining ?

is it below energy value at this point ?

I read today that there was a single 653 Btc sell order (0.003% of total float) that dropped the market 6%

if mstr gets liquidated that’s 130,000 coins

then 200,000 coins recovered from mt gox with at least some recipients willing to get out at any price as they probably bought under $100

There just isn’t any real money to absorb it , the greatest fools are all broke at this point

so we are relying on ftx/alameda to think there is more life left in the ponzi

There are tens of millions spent in electricity and hardware costs in mining BTC each day. This represents a continuous outflow of liquidity from the system for no other economic purpose than hodling. Matthew 25:14–30 has some interesting lessons on hodling.

I’ve long maintained that there is virtually no real liquidity in the crypto. Between the crypto exchanges I would be surprised if there was more than $5bn in genuine fiat liquidity between all of them.

The only real liquidity outside of that is probably only found in USDC ($55bn) and BUSD ($18bn), as both of those operate in and from US markets, so they would have at least some funds. The issue though is how much of their ‘other assets’ are simply CP and other IOUs from related exchanges? I would certainly give their market value a 25% haircut as a minimum to approximate the true USD liquidity behind them.

So I’d guess that the global crypto market capitalization of some $816bn is probably only potentially floating on some $60bn of real USD liquidity…. that is assuming that holders of USDC or BUSD will step in and buy it at some point instead of just cashing out, in which case there is only about $5bn in real liquidity available for the market to price test against.

I would estimate real liquidity to be somewhere between $60bn at the very high end and $5bn at the low end.

Hey, the EZFKA Twitter feed is a ripper. Who’s running that?

https://www.smh.com.au/national/nsw/nsw-to-trial-shared-equity-scheme-to-help-nurses-teachers-buy-homes-20220619-p5auva.html

EZFKA Strikes Back !

How long before fed and state buy 50% each?

yeah …. wonder what they’ll call it?…. the bipartisan intergovernmental housing affordability initiative? ..seems a bit wordy and dense ……

hey how ’bout “social housing”?

What a novel idea!

Watch it be expanded next year.

Letting marginalised borrows pile into real estate in the face of a major economic catastrophe with 2% deposits, what could go wrong!

Do you think the modelling behind these brain farts even considers price declines? The only winners in this will be the developer mates who get to flog off inventory in a dead RE market.

Last year we had a discussion about the progression of battery technology. Since then there has been an accidental discovery that will make Lithium Sulfur viable. 3X the energy density, 2 x recharge cycles, and cheaper to manufacture than Lithium-Ion. Mass production estimated 5-6 years away.

Curious to know people’s thoughts on whether this is true or bs.

https://www.youtube.com/watch?v=tHRoefpqMaM

What inflation ?

https://www.spas.direct/plungepools

thats a big discount

couldn’t get a prefab pool for love or money 6 months ago

There’s going to be a big inventory overhang as these places have all over ordered , and everyone loses their jobs / disposable income

Yes, Zerohedge has been posting about excess store inventory in The States. I guess its inflation in things we need, not garden furniture and spas.

Just waiting for the nsw govt shared equity pool/spa scheme

Yes, stagflation as we see major prices increases in everything essential, leaving no leftover lolly or equity mate for the crap hollowed out service economy which is all that Australia has left. Buckle up.