Over the last few months I have encountered multiple young couples that have recently purchased property. These people are not property investors. They are young Australians all around 30yo who have decided it is time to get married and raise a family. Some of them are now realising they have been served up a shit sandwich of rising mortgage repayments and falling property values.

The latest house price rises have been bugging me. They seem more sinister than the standard MOAR followed by a minor correction. In the context of RBA making it clear that stimulus measures like TFF were temporary emergency measures that would be withdrawn, I ask myself the following questions:

1) How did a temporary 1-2% mortgage rate reduction end up manifesting itself as a 25%+ increase in property values?

2) Did the banks treat the rate cuts with a GFC Subprime-like permanency?

3) What regulatory tools are available to prevent temporary rate reductions being treated as though they are permanent?

Serviceability Buffers

Australian banks are obligated to factor in Serviceability Buffers. These are a contingency rate added to the variable rate in mortgage calculators to ensure that mortgage holders can cope with potentially higher rates in future. It is the perfect tool to use to give mortgage holders a temporary reprieve on repayments during a recession, whilst still forcing the banks to consider future rates in new mortgage applications.

These buffers are determined by APRA. Here is what RBA recently said about Serviceability Buffers:

“In 2019, APRA indicated it expected banks to use a serviceability buffer of (at least) 250 basis points. In early October 2021, to address rising systemic risks, APRA increased the buffer it expects banks to use to at least 300 basis points.”

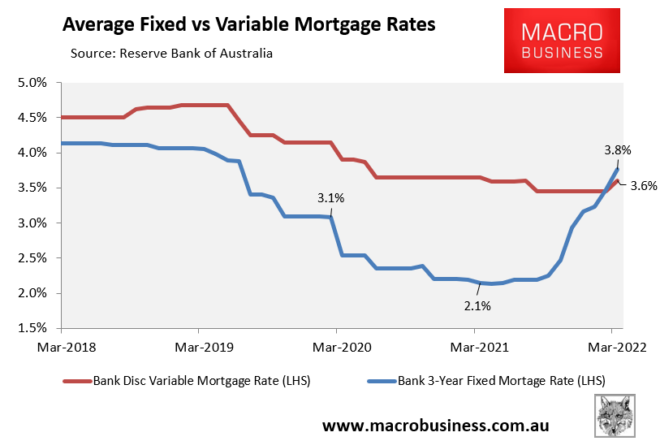

Look at the mortgage rate chart below. APRA waited until October 2021 to raise the buffers by 0.5% to 3%. October 2021 FFS! Up until that date they permitted mortgage rates to fall and to be treated with some permanency in mortgage calculators. The banks were more than happy to lend out the limits being displayed by the mortgage calculators, especially with idiot Scomo offering up 15% deposit guarantees. The net result is recent borrowers have ended with a much larger mortgage than what should have been.

Should have been more holistic.

https://www.keeptalkinggreece.com/2022/05/23/pm-mitsotakis-holistic-approach-young-greeks-no-money/

that’s right, Freddy – interest rate buffers for assessment are a great tool and could indeed have been used to dial down existing borrowers’ finance costs, without expanding the debt burden for everyone.

but this time, like every other time, this has only been the theory – the practice has been quite different.

indeed, there are a bunch of other MP tools that could’ve similarly been used to suppress borrowing costs while keeping the amount of leverage the same. But, likewise, they have all been used in an MPLOL fashion 😉

I guess it’s the inevitable outcome while the broader religion is “property” and the zeitgeist is “always go up” and the ideology is neoliberal, such that nobody dreams of regulating how much debt is taken on by individuals…

but even more so when NOBODY wanted to be to blame for upsettting the precarious balance of the supposedly very fragile pandemic economy.

that’s why it was always interest rate rises that were needed to squish nominal prices 🥸

honestly , wouldnt huge wage push inflation be the best way to get out of this?

nominal wages go up which makes these absurd house prices suddenly very reasonable

At the same time, interest rates go up which limits future loan growth

the oldies love it because their asset values don’t collapse, and they can get good term deposits to fund their cruises

the young people love it because they suddenly get pay rises

the government loves it because their tax take increases

Who loses in this situation?

at this point wage increase would cause inflation to further increase and currency debasement. Lettuce at 10 bucks?

this would’ve not been the case if houses were part of the CPI over the last 20 years and they followed inflation of assets.

my view used to be the same, that this way brings a sheet load of other problems.

my current view is that if for some inexplicable reason they decide to lower the house prices, the least painfully way is to trim and shear the top. Remove capital gain over long period and many investors will drop out if they are not ahead the interest and not renting…. then the next step… or simply remove speculative component from it. Alas… I can only daydream…

to the Moon and beyond!

I have been wondering why governments don’t embrace a 70s scenario of wages tripling and inflating away all the debt. It seems like a win scenario for everyone except those who only have savings and no intentions of buying assets.

Metricon has changed my mind on that. Businesses are more indebted than they were in the 70s, and wedded to slave labour. That brief period of rising input costs (debt, materials, labour) will be a killer for many businesses who cannot immediately factor those higher input costs into a higher sale price. And if you are like Metricon whose business is selling assets then you are doubly fucked.

It would be a similar deal for property owners. If debt repayments rise 30% in quick time and wages are “only” growing at 5% then there is a short period of stress before wages push up asset prices even higher.

I don’t know if there is anything special about Metricon, either in itself or as a representative of a class.

Any sort of transition is always painful.

but especially one that flips the script upside down, making yesterdays loosers today’s winners (and vice-versa). As I quipped to coming above – high interest rates and high salaries would be a very profound flip.

I don’t think anyone would go there, unless the alternative begins looking like literal heads on pikes.

Unrelated. If I view this site without a session (icognito or delete session cookies) the response times are fine. Once I am logged in it runs very slows.

Is there some sort of user activity tracking that could be slowing the site down for logged on users?

Pretty sure this is a honeypot of some sort

Coming, you are by far the most paranoid one here.

You have mentioned “asio” and “honey pot” (or “honeypot”) 522% more times than the next most frequent user of these terms. And over 1,400% more than the statistically average user.

If he was that paranoid, he’s announces his own blog or site… 🙂

im no techie, but the issue – as I understand it – has been something to do with bad database performance.

apparently all the articles and comments live in a database and are fetched fresh every time someone wants to see them (or post a comment). When the database isn’t working well enough, things get fetched very slowly or not at all.

for not-logged-in users, there are cached snapshots of pages. they live somewhere else, outside the database. So they load quickly, but they can be a few hours out of date (and so have missing comments)

The interest component of debt repayments rises

but the principle does not

and isn’t the principle the problem ? Like these mortgages were never going to be paid off

but if wages rise …

it would be a sort of semi debt jubilee but also at the same time encourage people to work more hours and more efficiently (to take advantage of the higher wages)

the wages would be used to pay down debt (given the very high interest rates this would make sense for the debtors)

essentially a debt jubilee where the creditors are made whole (albeit the returned money would be debased in real value )

then we start again from a much higher interest rate , and with a much lower real/nominal debt level

Debt repayments initially rise much faster than wages. It will take a few years for wages to catch up. Those few years will be a period of stress for many existing mortgage holders. It will also limit the amount new buyers can borrow.

What is unknown is number of cashed up individuals jumping into the market to protect their wealth, and whether there will be enough of them to stop prices falling, or to push prices even higher.

yes, in reality this is right. Something like UAP policy if 3% interest rate caps would be one way of “fixing” this.

But, in reality, it’s really a form of handing a loss to financial capital.

as a separate thought – interest components of debt service also fell much faster than wages. That was a free kick to the “old” borrowers and there is no reason why that shouldn’t be taken right back. ….Except of course that there is a bunch of “new” borrowers who have piled in either even greater liabilities. Which is always the case, because MPLOL.

another thought that I’ve been having is the role of publicly held companies in situations such as this.

Like, if Hancock or Linfox have been raping some community for some decades and then later they are handed the cost of reparation and restitution today – this seems undoubtedly fair.

but if it’s listed Westpac who has done the raping … is it fair to hand the costs to today’s shareholders?

I suppose it’s a similar phenomenon to individuals moving through roles in corporates… moving out well before they can be held accountable for consequences of their decisions…. It seems to make nobody responsible.

who loses? Capital loses.

what you suggest would reverse the course of many many years (decades) of the process by which labour has been undermined and capital strengthened.

so, by definition, what you suggest cuts right across the existing vested interests and power structures. Makes it unlikely to happen in my view.

Does capital lose if prices increase at the same rate as wages ?

since wages are only a part of input costs, that means margins also increase

obviously there are going to be cases like Metricon who have fixed contracts that they can’t meet , but these can be renegotiated or phoenixed

I see what you’re driving at, but when I think through it, I think we get nowhere… not unless capital is made to eat it.

say tomorrow wages rise 2-fold and prices do too. Instead of handing over a $10 for a happy meal, you pay $20.

But McDonald’s has to pay twice as much to the burger flipper, young counter wench, the electrickery, the rent, the rates, the maintenance, the banker, the franchisor…

the margins don’t change in percentage terms. They are jsut twice as big in nominal terms. But doesn’t have any more purchasing power.

I think that the only thing that happens is that the AUD goes to 0.35. And maybe you get to decommission the 5c coin.

If you want anything other than an exchange rate adjustment, you have to hand the loss to someone, to make labour relatively better off. It has to be at somebody’s expense.

now, you can try to choose who wears it (maybe it’s the landlord, maybe it’s the franchisor, the lender, the power provide), but I don’t think you can avoid it altogether.

you can also try to “grow the pie” and give a bigger share of the future growth to labour, but that is haaarrrrrddd in real life. And takes a long time.

It’s more about being able to pay down the principle

Currently this simply isn’t possible for most mortgages , which is why this is a Ponzi scheme

inflation maybe fixes that

Thought experiment

fred used to make 200k a year

-he originated a loan of 1.5mil (7.5x income)

-at 2% variable rate

-he paid 30k/year interest (15% of income)

-living costs are 50k/year

-tax is 70k/year

he can pay down the loan at 50k a year at best (take 25 years)

if his wages double to 400k/year

-living costs double to 100k/year

-tax is now 170k/year

-interest rates get to 6% = 90k/year

he can now pay down the loan at 70k/year (now only takes 20 years to pay off the principle)

Even better, probably the government throws some tax cuts around due to “bracket creep” (since their tax take will go up disproportionately anyway)

maybe another 50k/yr if they want to keep Fred’s tax proportionately the same (25%)

now he can pay it down at 120/yr !

or they simply make owner occupier mortgages tax deductible (this is highly likely imo)

or Fred simply “rentvests”

now you can see how wage inflation can help make debt levels more normal

probably the numbers are off but there will be rba and govt assistance to make it work in the end

the numerical example is a good thing to have. 2 thoughts I have as a result:

with regards to your first point I think I made it fairly aggressive 7.5x income and 50k (excl mortgage/housing) is a reasonably generous cost of living for someone on 200/yr? Or am I out of touch

What do you mean “eats it” ?

not sure I understand

the bank made that money for doing nothing

they created the deposit from nothing

as long as the loans don’t default or the asset value doesn’t fall , it’s all gravy for them

they don’t collect 6% or 2% every year – they take a margin/spread (which is probably slightly higher at 6% than it is at 2%)

the point that the principle that is paid back is devalued is largely irrelevant to the bank since that principle came from nothing anyway, and they will simply originate new loans at higher prices

the factors that matter for them are

-aggregate debt levels (increased in my scenario as loan sizes will increase)

-margins (probably greater in my scenario, or at least the same)

the point is that inflation makes REAL debt levels lower, and therefore more manageable

the far bigger problem would be wage deflation or unemployment, since the loan would be in default

I don’t want to get into the debt creation mechanics here because I think that it’s beside the point.

Let’s just acknowledge that for each borrower there is a lender somewhere. I called that lender “the bank” for simplicity. Perhaps it’s more accurate to point to the bond holder…. Doesn’t matter. there’s a lender. And the lender cops a loss of the purchasing power of the principal+interest received is less than the purchasing power of the amount initially lent out.

so it’s no free lunch. Somebody wears it. Bank shareholders, bank depositors and bondholders, etc, etc…

Lucky the central banks own the bonds

but this is why it is important to discuss the nature of loan creation

the bank creates a loan

it now has an asset (the property and attached mortgage)

and a liability (the new deposit which gets transferred to the vendor)

if it has to sell bonds, it’s to maintain capital ratios

unfortunately bond holders across the board have already been hurt , as yields rise

that is mostly super funds and central banks

I don’t think what you’re describing is quite accurate.

But if you think that bondholders have already been hurt, surely you can see how they’ll be absolutely raped with 6% interest rates.

AUD would go to 0.35-0.40 (look at me, I’m DLS! 😋) on account of foreign bondholders, etc.

and to the extent that the bondholders are government or superfunds (backstopped by government, as pension payer of last resort)… it’s the youngins (again!) that are paying the price.

Im sorry, I don’t think that there’s a nice financial engineering solution that keeps everyone whole while makings borrowed better off.

There are probably heaps of practical solutions in terms of industry policy and migration policy and housing policy that would hurt less than outright distributive interventions, though

Why would the AUD go down ?

if interest rates go up relative to overseas , surely the opposite would happen

as I said, the effects would be to reduce the size of the financial economy relative to the real

that means bond holders get hurt, and banks reduce their relative but not nominal size (preserving solvency)

AUD would fall because a fixed number of AUD now buys much fewer Australian man-hours and therefore much less Australian product.

if you have to pay the aus shearer $15 per sheep instead of $7, you don’t get any more wool, nor is the wool worth any more at sale.

especiallu if the kiwi shearer still gets paid $7. The AUD falls to compensate.

now, it probably doesn’t go down quite by 50% because mining which is special and big.

(and of course I know that most industries have some kind of mechanical leverage to raw manpower, but that mechanisation is matched in other locations too, so it reduces down to labour cost)

Don’t think it’s that simple since Australia’s exports are not labour intensive

like I say, mining is special, because we have the minerals* and others don’t.

for other stuff it’s a wash – to the extent that the exports aren’t labour intensive here, they are also not labour intensive elsewhere.

so you can’t recoup any additional cost of labour that you add here. The AUD falls.

Mining makes up two thirds of our exports

agriculture also not particularly labour intensive these days

if the AUD goes down as you suggest (though I don’t quite understand why) , that only makes the remaining tiny fraction of our exports (tourism and “education”) all the more appealing which reduces the falls anyway

like I said, mining is special and big. And that’s why AUD won’t go down 50% if you double salaries.

tourism is probably a good way to illustrate why it falls. If someone was ready to spend USD$7,000/AUD$10,000 on an Australian holiday, they won’t spend USD$14,000 just because aus salaries have doubled by magic.

they still have their USD$6,000 and they demand as much holiday. So USD$7,000 must now buy AUD$20,000 worth of aus holiday.

Right

but as you say mining is special and really the only thing that matters with regards to the AUD

as well as interest rate differentials and carry trade which would be bullish for AUD

wages are really just the price that we charge to make coffee for each other , and has no effect on terms of trade or the external sector

So we can now use our twice as many AUD that hasn’t adjusted due to mining to now buy twice as much stuff from the rest of the world in exchange for the same amount of mineral/agricultural exports?

Same exports/twice as many imports in your 100% inflation scenario.

The price of foreign goods will only inflate if our dollar falls, and that is most goods.

Where are you getting twice as many AUD from ?

increasing wages increases the velocity of money, not the amount

Zoom out, coming.

today $X billion buys all the labour in Australia for a year.

tomorrow $2X billion buys all the same labour for a year.

exports that are actually produced are not impacted by this multiplication exercise.

something will give. And it’s the fx rate.

we don’t need to argue about whether it’s exactly 1:1, or 0.9:1 because of mining & other circumstances.

No idea what you are saying

changing labour costs does not change the amount that we receive for our exports

it changes the profitability of our export producers, but labour has a relatively minor impact on production cost of mining (which are mainly energy and infrastructure dependent)and probably has negligible effect on viability

if we export $US100bn of iron ore

that might “cost” $AUD5bn in wages today and $AUD10bn tomorrow

But that money doesn’t disappear nor does it need to be created, it’s a flow not a stock

the amount of USD we receive is unchanged

no new AUD were created to pay the wages , they simply change hands

stock vs flow

it changes the amount spent on imports though…

at least in the example being discussed here.

How

because if I earn more money, I spend more money.

And a significant portion is spent on imports.

How can it not increase money spent on imports? Do people not buy anything from overseas?

All the importers of goods just get windfall profits by doubling what they sell good on for but pay their foreign suppliers the same in USD?

How exactly do you think it wouldn’t change imports?

It depends entirely on your propensity to consume, which will decrease as interest rates have risen , and as the cost of local services consumes more of your income

how is this hard to understand

So explain it then. In real fundamental nuts and bolts terms.

The reality is you can not increase inflation in an open economy like ours by just increasing the velocity of money, at least not without also increasing it in the rest of the world. Too many of the costs are external and completely unaffected by anything the AUD does.

lol.

If my wages double i have twice as many AUD to spend on everything, housing, services and GOODS.

Or don’t I?

In the words of a famous ranger

PLEASE EXPLAIN…

edit:

Or alternately, if the cost of cars, computers, boats, furniture, clothing, and on and on was to halve in real terms, what would happen to demand?

You have more to spend on services , which have doubled in cost

you have more to spend on your mortgage interest payments, which have tripled

you have more to spend on paying down principle

you have more to spend on goods, which now have increased distribution costs

and so on and so forth

stock vs flow

OK sure.

Whats the distribution vs production cost on say a car?

Lol why don’t you acknowledge all the other costs I just listed

You’ve literally just said you doubling salaries doubles the amount you have to spend on imports

which is patently fucking stupid, as I’ve just explained to you

Because they are not at all related to imports, which is what we are discussing regarding exchange rate. I agree that all the internal costs can double in your inflationary environment but it is the externalities that make your argument incorrect.

You are clearly claiming a $100,000 car today will not change cost in real terms or the amount imported would change, so where does the extra $100,000 paid for that car actually end up in your mind?

Clearly not the manufacturer, or the shipping company bringing it here, or export $$ value has changed. So where?

realistically a $100,000 car costs maybe $1000 to truck to it’s final sale point from the boat. that doubles to 2000. theres maybe a $10,000 profit on said car. doubles to $20,000. so your $100,000 car is now $111,000.

or we can make the profit $20,000 and it’s now a $121,000 car. What happens to the other

$79,000 that would be a doubling of the costs?

Do we get cheaper cars and import more, send it to the manufacturer and increase the AUD sent OS, or it just magically disappears economist numberwang style?

Edit:

Or are you claiming that somehow only the amount spent on services and loan payments is going to increase along with wages and not goods?

I’d love to hear a justification for that hypothesis.

i hope it’s cheaper cars (and shoes and gold jewellery) but somehow that seems the opposite of what would happen.

in reality I think foreign things be mostly the same price and the exchange rate would adjust so that foreign goods inflate as much as wages do. Either that happens or the amount imported would increase drastically without a corresponding increase in exports and the rest of the world is accepting that because???

Or to get all technical and economisty there would be a surplus of AUD external to the country looking for something to do, and this would lead to exchange rate pressures and a falling AUD.

But I rate economists right down around pharmaceutical companies so much prefer a common sense nuts and bolts approach than their garbage…

No you haven’t. You’ve explained for a very particular person in a very particular level of inflation who spends exactly half their mortgage interest payment on exports before the inflation event that they will then have exactly the same after the inflation event to spend on imports. For anyone else it will change either up or down.

also, on the above – you can’t have it both ways.

if loan sizes will increase, you haven’t deleveraged shit.

all you’ve done is handed another free kick to existing houseowners.

well you have deleveraged by definition if incomes rise more than loans (which they will if interest rates rise)

the banks existing loans don’t lose anything is the point

wage inflation will however reduce the financialisation of the economy and the disproportionate size of the banks

which is a good thing

nah, you’ve deleveraged some by leveraging up others (the next generation).

this is what’s been happening anyway.

Your plan kind of proposes a way to keep it happening for some time longer notwithstanding that we’ve bounced off the 0% interest rate bound.

what you have to deal with is asset prices relative to incomes. Or returns to assets vs returns to work. To do this, you must create winners and losers.

Either quickly, by cutting asset prices, or slowly, by letting incomes grow but not letting asset prices grow.

both of these make capital (asset owners) lose while making labour (income earners) win.

real asset owners don’t lose since they produce value which is now denominated higher

financial asset (bond) owners lose

asset prices fall relative to wages, which is simply reversing the effect of several decades of falling interest rates

the alternative is endless stagnation as the debt can never be repaid

I will give you an example of a Boomer with a $2m house (owned outright) in Sydney and no other income or assets. For the sake of simplicity let’s pretend they need $50k per year to live in retirement and not eligible for the pension.

Today: they can sell that house and buy a $1m pad in Gold Coast and be left with $1m cash which is the equivalent of 20 year worth of retirement income.

Let’s pretend interest rates rise significantly and house prices half relative to income. House prices have doubled but incomes have quadrupled. That house now worth $4m but they need $200k per year to live in retirement because rising wages result in an equivalent increase in cost of living. They sell the $4m house and buy that same pad in Gold Coast which is now worth $2m. They are now left with $2m cash which is the equivalent 10 years worth of retirement income.

Not at all

the $2m in the bank now earns them $80k/yr in a 4% term deposit

Someone else can do the maths but that dramatically changes how long the money lasts

previously their $1m in the bank would have earned a paltry $10k/yr in a 1% term deposit

and only in the first year as they rapidly use up their principle

You have plucked those 1% and 4% figures to suit your argument, and also ignoring inflation and taxes on income. The reality would much closer.

youve plucked yours as well to suit yours

maybe mine are more realistic

if cost of living quadrupled as your scenario proposes, I would imagine that interest rates would at least quadruple if not more

If you were to capitalise by downsizing in an inflationary environment you would be left with less cash in terms of purchasing power. That is a simple fact.

I suggest you familiarise yourself with an annuity calculator. You would need a much higher differential than 1% vs 4% and that is still ignoring the higher inflation and taxes.

Annuity Calculator – Bankrate.com

depositors and new bond purchasers are compensated for inflation with higher yields

youre also ignoring the reverse mortgage (with doubled principle and quadrupled return)

even still the results I get from your calculator is 12.4 years

Exactly. If you are earning 4% then a big chunk of that 4% is compensation for inflation. The real yield is closer to zero. And then you also have to factor in taxes.

so what’s the alternative?

because debt systems are not designed to be stable or static

We are near the end of the debt road

The final result is deflationary collapse, and negative interest rates, as well as falling property values, ala Japan

So his $2mil house is now sold for $1 mil (though he can buy the GC apartment for just 500k)

But now his 500k in living expenses is on deposit at -1%

So I understand what you are saying, retired people will be relative losers

But it isn’t that bad, they can just eat dog food, and the system will remain stable

or maybe it will encourage them to get back in the workforce, and actually contribute something to the country instead of coasting on their arses

Then, as workers on rising wages, they instantly become winners again

These cunts have had it good for too long anyway, young have sacrificed enough the last 2 (or 20) years

Sir, I think you have it wrong. the old asset holders will do well under your plan.

they would do poorly in a deflation.

the old povvos – they’re irrelevant. They only do as well as the govvie does for them. They have no savings to lose. And no debt capacity. They might as well be unpersons.

dont think they would

their col would increase faster than their asset values in this situation

and it would be “affordable” homes that would increase in value, more than high end ones since those aren’t really affected by wages but by financialisation and interest rates

My intuition on this is different. Maybe we can agree to disagree here.

on the one hand, you’ve claimed that capital would be the loser

but on the other hand you’re now claiming that the rich asset holders would do well?

Not sure how it can be both

I think we’ve drifted between different proposals over time.

in this context we are comparing debt/asset inflation with debt/asset deflation (https://www.ezfka.com/2022/05/28/apra-serves-up-inflated-mortgages-to-young-australians/#comment-23626)

we are evaluating the effects of wage rises and wage-push inflation via an EZFKA lens

Naw, that’s just where things started.

that evolved to wage-doubling-diktat, then to something else and something else….

Anyone who owns real assets see the value of that asset increase while the relative value of the loan used to purchase it decreases.

Anyone who is the lendee on those loans (ie capital) sees the real value of their loans decrease without any asset price increase(they don’t own the assets). unless interest rates outdo inflation, which means the debt is not actually being inflated away.

There is one exception… property. Rental yields are linked to income. If you downsize the sensible thing to do is buy another property. It doesn’t really matter what stage of the cycle as you should generally be able to buy a similar amount of property with the change.

The goal is to retire with enough property to live off the income and not needing to draw down on equity.

Geez. I am sounding like a Boomer.

Propadeeeeeee!!!

I skipped the school on the day they were teaching mplol.

Wha da crack is MPLOL?

Macroprudential lol.

Same as “lower teh rates”. “Loosers”

Evolved from MB.

DLS kept banging on about macroprudential coming.

With his usual leftist twisted logic, the government will import 400k migrants a year to boost housing, to then regulate its’ rise via APRA.

that is one helluva sarcasm. I bet it causes a twitch in face each time it is written.

As far as I know, mplol means macroprudential lol.

I could be wrong.

I wasn’t purposely being sarcastic.

did not mean you were sarcastic; the “MPLOL” it self, if relating it to Llewdo, seems that way though

The context was DLS pushing for the RBA to go to zero and even negative interest rates and arguing that it wouldn’t cause house prices to rise, because macroprudential (MP) policy would be put in place to prevent that.

This was contrary to many commentators’ understanding of how interest rates impact borrowing power, and those cynical of the politico-housing complex simply responded by laughing out loud (LOL).

The commentators were right, as despite near zero interest rates “MP” never eventuated and prices continued to boom, making a mockery of claims that anyone in the halls of power pays attention to embee.

Whether any of these mp restrictions are likely to be enabled to limit loan growth really comes down to a fairly simple single question.

Is the stimulatory effect of interest rate reductions caused by reduced loan repayments or increased monetary supply via increased loan amounts primarily?

The marketing says reduced loan payments but i lean heavily towards increasing money supply being the greater stimulatory factor and if you take away that increase in loans with mp then the interet rate reductions become FAR less stimulatory.

that’s a good perspective bjw. The stimulators effect of small interest rate falls is small and takes a long time to accumulate to maningful sums.

but it can indeed be capitalised upfront in new lumps of debt on house sales. And equity-mate, which is a similar thing.

When I first read of Steeve Keen and his epic failure, what I learned was that the natural self regulation in capitalism is gone and that the imaginary society collectively referred to as ‘da west” has gone from capitalism to debtalism and that it is a commanded, governed economy. Approx 6 or 7 decades after Soviets, “the west” embraced soviet style controlled economy. Results will be differe, i was told.

No business was to fail unless it is small or medium in size. 2 birds 1 stone, eh, make big become bigger and small become smaller or disappear.

I could elaborate further but to avoid Gunnamattisation of the text, I’ll come straight to the point: nothing in economy regulation nowadays is connected to a free market. Not one policy is designed without checking how it serves a certain objective or agenda of a certain class. In case if home loans, expect anything and even that which Tim Burton may find excessively fantastic. It seems that the place Buddhist cal nirvana has been reached. Soviets thought too for the first 20 years.

yeh, there is no conceptual purity. There is only careful pandering to selected interests.

incrementally more pandering to incrementally more powerful interests. It is quite easy to see where this leads, systemically. EZFKA.

who is Tim Burton?

Oh my god, I have watched 0 of those movies.

is that really bad?

you gotta watch beetlejuice…

Seems like something that they only have on DVD….

Good post Freddy. This is the stuff I come here for.

Agree, good to see a serious thread once in a while.

https://principia-scientific.com/the-5-basic-laws-of-human-stupidity-according-to-cipolla/

Some places have more than others

OTA….

Mike Cannon-Brookes enjoying himself

https://www.smh.com.au/business/companies/agl-dumps-coal-split-plan-chairman-and-ceo-to-resign-20220529-p5apg4.html

https://www.smh.com.au/business/companies/fist-pump-cannon-brookes-finds-68b-ally-in-battle-for-agl-20220525-p5aofy.html

So as the actual mortgage rate increases can we expect the buffer to be reduced again? 😉

Aha, you’ve got your EZFKA thinking hat on!

Yes.

If house prices fall hard enough they will probably scrap the buffers altogether in an act of desperation.

Exactly

Watch that space in 9-12 months time

Are negative buffers a thing?

Does the government buying a share of the property count?

Lol

EZFKAPRA doesn’t really care about what type of sandwich a person eats. It only cares about the solvency of the banks. As long as dividends still flow to the elite, your 30 year old friends are just another economic unit to be exploited.

EZFKARBA says meat sandwiches can be replaced with shit sandwiches in CPI calculations.

🤣

Albo will celebrate it because it means more of the meat can be exported.

Bandt will walk around with a permanent hardon because boomer shit is being recycled.

Shit eh

https://uk.news.yahoo.com/astrazeneca-vaccine-may-increase-risk-154456972.html

Ahahahahhahahah!

if I recall correctly, the 1970s the swine flu Vaccine was canned after a 10 in 1 million rate of GBS.

5.8 is pretty close. Plus, the 5.8 would be horribly underreported AND these shitcunts forgot to count the SECOND AZ jab.

luckily the government doesn’t force inject you with campylobacter. Yet.

Not to mention that if you’re under 50 there’s basically no chance of dying from COVID.

If my chance of dying is 0.02% including all the fatties, diabetics, people with chronic disease, people with terminal disease, smokers, drunks, drug addicts, etc, then if I halve my chance of death then I’m still almost 0% chance of dying. Exclude the fatties there’s no chance of dying if you’re healthy.

So taking the jabs you might theoretically (if we are to believe the numbers that changed from 95% protection from catching the virus to no protection from the virus, little protection from hospitalisation, but you’re less likely to die) lower your chance of dying, but you have to balance that halving of a 0.02% chance of dying (that’s if you catch it to begin with which most won’t and the number includes all the fat slobs out there) with possible adverse effects immediately and down the track (something like GBS).

I’m sure they’ll uncover all sorts of nasties down the track.

If you’re 70 the calculation is clear take the vaccines, but anyone under 50 have the calculations all wrong.

id say you’re exactly right, except I’d say that most will catch it (or already have) and the age when the cost-benefit becomes sensible for generally healthy people is probably closer to 80 than to 70.

this I’m 200% in agreement with. There is no way you administer 3 billion does of anything without ending up with with a lot of side effects.

Which is why this weeks summit at DAVOS is all about “rebuilding trust”.

Sure you can, you just need the 5-10 years of properly designed trials before hand. Balancing side effects to benefits of course. Cancer treatments get to have a lot more side effects than a flu vaccine, for obvious reasons.

Kinda why the approval systems were put in place in the first place…

5.8 per million is essentially zero change of catching GBS too though

APRA on alert for loan repayment shock, chairman Wayne Byres tells AFR Banking Summit 2022

The Australian Prudential Regulation Authority is monitoring the impact of a “sizeable repayment shock, possibly compounded by negative equity”

I should write another version of this post as satire.