I was having a scroll through crypto twitter yesterday when I came across this meme and had a good laugh at it – then it occurred to me that most people would have no idea what it was about or the significant truth that lies behind it. While Cyberpunks like to celebrate its supposed anarchist roots and being a bit of a FU to the powers that be, BTC is actually very much controlled by the existing banking establishment.

To understand how establishment finance control BTC it is necessary to provide some background and start with the company which more than any other has both profited from BTC and controlled the narrative surrounding it, and that company would be Blockstream.

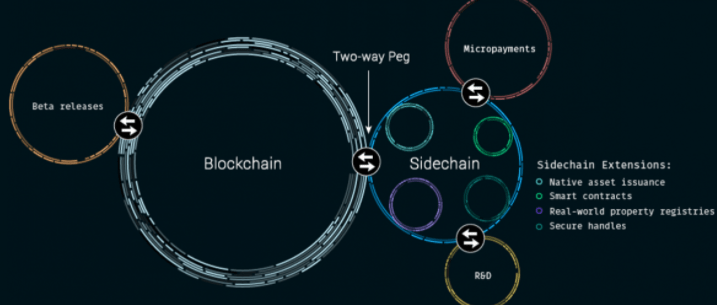

Blockstream is a technology company founded Adam Back, whose stated purpose is “to sell sidechains to enterprise charging a fixed monthly fee, taking the transaction fees and even selling the hardware”.

While BitCoin was originally designed in the White Paper as a single layer data and payment provider, capable of peer to peer payments (P2P) under the malign influence of Blockstream the purpose of BitCoin was transformed into a number of inter-connected side chains, with BTC at the centre, and the services and side chains provided by Blockstream hanging off the side and taking their cut:

Essentially under this model the efficiencies provided by blockchain technology, which were meant to be continuously re-invested back into the system to allow ever improving efficiencies and scope for more business to be built on top of it, to instead be transformed into a system where by individual functions that could be performed by a single blockchain, to be instead split apart and the efficiencies largely consumed by private fees. The fees from side chains do not go to the miners – they go to the developers of the chains.

Blockstream needed Bitcoin to be unscalable, with a hard block cap to ensure that mass adoption is impossible. Every failing of Bitcoin was a victory for Blockstream, because it allowed them to provide a patchwork service on top of the original protocol to fill the need.

However, the problem with BitCoin is that it was actually capable of doing EVERYTHING right from the start, so in order for the above model to be implemented it was necessary for Blockchain to break BitCoin, introduce various inefficiencies, and then be able to provide “solutions” for the very problems that it needlessly created, effectively transforming it from BitCoin into the BTC that we have today.

The first and most important influence that Blockstream played in transforming BitCoin into BTC was the small block narrative – being “BTC will only be secure if my Raspberry Pi can help protect the network” which involved taking the “distributed” processing narrative outlined in the White Paper and turning it into the “Decentralised” node validation model that Core enthusiasts have swallowed hook, line and sinker. The fact that Satoshi originally envisaged that over time as transaction growth on the network increased most of the processing would shift to large server farms and that most users of the networks in terms of service providers using the blockchain to run partial nodes has been continently brushed over.

To achieve this Blockstream firstly infiltrated the original BitCoin Core development team, essentially paying the salaries to various BitCoin developers, like Greg Maxwell and Luke Dashjr, who both stymied the scaling plans of BitCoin and began twisting the narrative into the “Digital Gold” that is so dominant today.

The capture of BitCoin Core by blockstream developers was completed in Gavin Andersen, who was the lead BitCoin developers who Satoshi left in charge when he stepped away from the project, was locked out of the Core developer servers and all the files transferred across to a new Github server in May 2016.

I won’t go into the details of the long Big Block Small Block debate that culminated in the first BitCoin chain split that produced Bitcoin Cash, however the debate started in 2014 and raged through to 2017. What is important to realise is the role that Blockstream played in the disinformation at that time and the significant role it continues to play in controlling the crypto narrative of today.

In 2017 Adam Back actually admitted to the fact that Blockstream employed a ‘large’ team whose job is to ‘debunk and disprove’:

Essentially this is the team that was lead by Greg Maxwell to argue that scaling was impossible (it has since been proven that it is), it was impossible to process large blocks (again they can and are being processed today) and that it is necessary to have small blocks for security (most BTC transactions are processed by a similar number of large scale miners as processes the other Bitcoin chains). Maxwell was also eventually banned from Reddit after found to be running a sock puppet army that was at the center of various Sybil attacks on any individual or organisation that attempted to run against Blockstream’s narrative.

Anyhow, while I could write at length about the dodgy stuff that Blockstream is responsible for and the even more dodgy stuff its various employees have gotten up to, that is not the purpose of this article, so to bring it back on topic – “How is BTC controlled by establishment Finance?”

Answer: Through Blockstream.

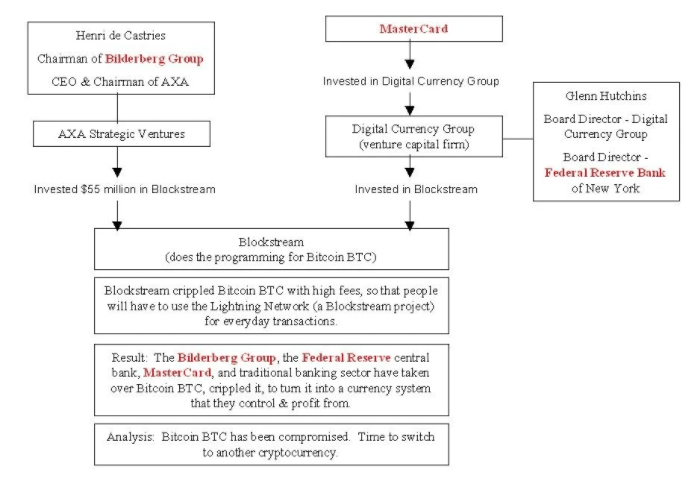

Currently these are the major shareholders and shareholdings of Blockstream and related affiliate companies:

In Feb 2016 AXA strategic Ventures, invested $55m into the first funding round A for Blockstream and as a part of that funding commitment joined Blockstream’s Advisory Board. Around the same time Blockstream also secured a similar amount of funding from the Digital Currency Group, which was founded by Barry Silbert who has an investment banking background.

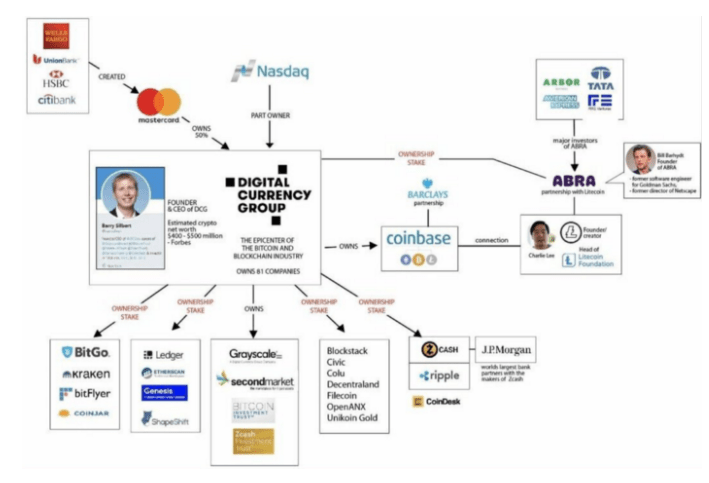

If there is ONE company that any investor in the crypto space should be aware of it is Digital Currency Group (DCG) and the role it plays in controlling literally hundreds of crypto companies ranging from online digital exchanges (I count at least 9) as well as many of the supposed Crypto media organisations that play such an important role in disseminating DCG propaganda.

So where did DCG group secure its funding from? Mastercard (among other):

Fresh off the heels of selling his first company, SecondMarket Solutions, to Nasdaq last week, financial whiz Barry Silbert is officially launching his next startup, Digital Currency Group, and announcing that it has raised an undisclosed sum from a number of investors, including MasterCard, Bain Capital Ventures and New York Life.

– Laura Shin, Forbes

So who sits on DCG board or as an “adviser”? Well obviously Barry Silbert, but there are two others that are particularly noteworthy:

Glenn Hutchins: Former Advisor to President Clinton. Hutchins sits on the board of The Federal Reserve Bank of New York, where he was reelected as a Class B director for a three-year term ending December 31, 2018.

Then there is the big Kahuna himself:

Lawrence H. Summers: Chief Economist at the World Bank from 1991 to 1993. In 1993, Summers was appointed Undersecretary for International Affairs of the United States Department of the Treasury under the Clinton Administration. In 1995, he was promoted to Deputy Secretary of the Treasury under his long-time political mentor Robert Rubin. In 1999, he succeeded Rubin as Secretary of the Treasury. While working for the Clinton administration Summers played a leading role in the American response to the 1994 economic crisis in Mexico, the 1997 Asian financial crisis, and the Russian financial crisis. He was also influential in the American advised privatization of the economies of the post-Soviet states, and in the deregulation of the U.S financial system, including the repeal of the Glass-Steagall Act.

Together AXA and Mastercard, through their control and influence of DCG have played an enormous and important role in shaping the crypto industry that we see today, and turning BitCoin, a system of limitless scaling possibilities, into the expensive, crippled, fee driven abomination that we see in BTC today.

Why would they do this?

Contrary to the popular media narrative the likes of which MB has swallowed, BitCoin and Blockchain technology does present enormous cost saving opportunities – just not in the form the BTC has been transformed into (MB and DLS is 100% correct on that).

AXA recognise the savings in the technology, having previously issued statements such as:

“We are convinced that blockchain technology has the ability to transform not only financial services but also other industries. Blockstream has one of the best technical team in the industry and we strongly believe in their approach of developing foundational infrastructure for various blockchain applications. Blockstream’s open source approach and sidechains will enable critical long-term success of this technology. We are excited about the close partnership that we will have with them in driving deeper engagement, thought leadership and technological transformation in the world of insurance and asset management as we believe that in this industry, blockchain technology will be a conduit for systematic changes.”

– François Robinet, Managing Partner, AXA Strategic Ventures.

So it is perfectly possible that AXA are invested in Blockstream simply to back the Blockstream business model based around building sidechains and syphoning off economic value from BTC by introducing inefficiencies, providing solutions and charging fees for the service. Lacking any further evidence around their motivation I’ll accept that.

What about Mastercard? Here I am not so sure, Mastercard haven’t exactly made much comment in regards to their blockchain investment, so in Mastercard’s case I’d rather examine their actions rather than their lack of words. The best place to start in this regard is to examine what they have been up to in terms of securing patents over blockchain technology:

*I think this chart is actually a little dated, as I’m pretty sure that China now leads the patent filing through Alibaba or Ant group finance or whatever it is called now.

Personally I’m of the opinion that Mastercard are well aware of the economic savings that can be potentially delivered by blockchain technology and through their investment in DCG and Blockstream are working to stymie development in terms of the original vision for BitCoin while the work to develop their own blockchain technologies, with them acting as middlemen:

In all of these cases, cryptocurrencies still don’t move through our network. Our crypto partners convert the digital assets on their end to traditional currencies, then transmit them through to the Mastercard network. Our change to supporting digital assets directly will allow many more merchants to accept crypto — an ability that’s currently limited by proprietary methods unique to each digital asset. This change will also cut out inefficiencies, letting both consumers and merchants avoid having to convert back and forth between crypto and traditional to make purchases.

Added to this work, Mastercard is actively engaging with several major central banks around the world, as they review plans to launch new digital currencies, dubbed CBDCs, to offer their citizens a new way to pay. Last year, we created a test platform for these banks to use these currencies in a simulated environment. Using our deep experience in payments technologies, we look forward to continuing these partnerships with governments and helping them explore the best ways to develop these new currencies.

Mastercard

Why should we care? Well quite simply BitCoin was designed as a public, transparent ledger designed to shed light upon the movement of money. It’s main competitors are private, side chains or in the case of Mastercard, entirely private ledgers. If BitCoin as a public ledger fails, and this is what I fundamentally believe BTC is being set up to do with the Ponzi that is being encouraged through the lack of regulation, then once it fails and fails spectacularly, then the rules and regulations will come thick and fast and close the technology down in all but private use cases. This is what I believe the purpose and end game is for the BTC and ‘digital gold’ bubble.

If that occurs, then blockchain technology has the potential to turn our future world into an unparalleled financial dystopia – where every expenditure we make can be tracked and traced by Govts and private corporations intent on milking us like cattle for every productive endeavor we engage in.

If the chain is too large it can never be public. A “Public” chain locked away in a server farm is no more public than a private database in a server farm. Block size was limited precisely to maintain that publicness.

The transaction record will always be publicly accessible and stored on a number of server farms. OP_RETURN data may be pruned or privately warehoused, but that is separate from the transaction record. The limiting of the blockchain size to 1mb is the Core narrative that has been popularised by Blockstream. It is false.

Except it isn’t.

Care to declare any financial interests in alternative crypto?

Sure – I’ve made no secret that I’m a big holder of BSV, which follows the original white paper and has thus far proven all the Blockstream narratives false. I have however refrained from directly pumping it here as its ultimate success is far from secure.

Will it eventually run into storage problems? Maybe, these issues were dealt in the original white paper – see section 7.

But there are currently hundreds of millions being invested in the technology that says it can (see TAAL enterprises), versus the Blockstream narrative that says it can’t.

Many people said it was impossible for planes to fly or to travel to outer space – you don’t know until you try. Corporations like Blockchain say you can’t. Corporations like TAAL say you can.

Feel free to disagree and back the narrative that you choose to believe, or put together an article as to why you believe it can’t.

But before you do, take another look at the very first diagram I included. That Blockstream model has ALL the same data available electronically over the internet, only through side chains and private data storage. Why is that model feasible and the one I’ve described and as outlined in the White Paper not? Data is data, what we are talking about is fundamentally how it is sliced and diced.

Surely if 1 + 4 = 5, then 4 +1 must also equal 5 ?

A diagram does not a system make.

But of course a system that supports that is FEASIBLE, they are in operation all over the world already.

They require a central server to hold all the data though, not a public blockchain. Putting a blockchain in a dedicated server farm turns it into the thing you are complaining about.

We’ve already done the maths on how completely impractically large a blockchain will become to support transaction rates you are talking about. At that point bsv may as well be mastercard for all the practical difference there is.

Maintaining the blockchain as a practical, public ledger that anyone can verify and is stored in hundreds of thousands of locations is the whole point of blockchain and why the size limit is imposed on bitcoin.

At the point no-one but a central server farm can hold the blockchain and you just ask them about an individual transaction you are at the current paypal/mastercard/bank model and have to TRUST what they are telling you, whether it’s stored in a blockchain or a database.

And frankly, your system will be outcompeted by someone using a much simpler and cheaper database system requiring far less server resources to undercut you, since you no longer offer the reduced counterparty risk that bitcoins provides by being non centralised.

Coolieo – then we have a market !!

As I’ve said many before, the purpose of the Blockchain ISN’T to replace databases, it is to provide an auditable and public chain of transactions, where the public assurance for the transaction type cannot be otherwise guaranteed without requiring a trusted 3rd party intermediator, such as someone providing a cheaper service via a private database.

Enterprise databases will store the OP_Return data, users will pay to access this data. The Blockchain and its coins will simply be the settlement transaction layer were the exchange takes place on and is publicly recorded, and this record of transactions will be distributed as copies and as an indelible on the blockchain across large professional mining farms.

You seem to be deliberately obtuse. If the blockchain is only stored in one place then it is trivial to manipulate and interfere with the data stored in it.

They become the trusted 3rd party.

The distributed nature of the blockchain is what guarantee’s the trust, not that it is a blockchain. If you have no alternative to compare against you have no option other than to trust what you are given.

Now you are being genuinely obtuse as opposed to using the term as an ad hominem – I didn’t say the full blockchain would only be stored in one place, copies would exist and be stored at large commercial mining farms, of which there will probably end up being maybe 5 or 6.

This article wasn’t about technical aspects of Bitcoin, it was about ownership and who influences control over it and the narrative that is pushed.

I’m happy to discuss my views on technical aspects, but if you want a good faith dialogue fuck off with the obtuse calls – I can personalise insults and wrap them up in arguments better than most. It isn’t my preference to go down that road, as ultimately it isn’t productive in uncovering any truths other than who can slag someone off the best.

5 or 6? So few could easily be subverted. Bought. Hacked. Strong-armed by govt(s). Nuked. Or even jsut have power cut.

While there are around 40,000 nodes on BTC, there are only about 20 full nodes that aren’t parasitical and actually create blocks “mine” on a regular basis, and of that number a mere 5 or 6 miners of that list control the majority of the BTC network hash rate.

I dont know why I bother but here

Cool – now how many independent miners are in those mining pools and how much Hash do they contribute as a percentage of the overall network?

https://arxiv.org/pdf/1810.02466.pdf

So the reality is those Rasberry Pi miners, probably contribute two fiths of fuck all to the remaining 20% of hash and transaction processing that occurs outside of China.

The majority of existing BTC network is controlled by Individuals or companies existing within China.

Much decentralization. Big wow.

The point is the proposed hashing security offered by 6 distributed server farms, is much the same as the existing security offered by the BTC, only it is likely to end up being much more distributed geographically, with less dependence on China.

Except those 6 miners cannot alter any past transactions because I have a copy of the block chain that I or any other person can compare their version to and see any changes.

Do you see the difference yet?

Yes I do see, as I have seen all along – but that would require collusion between 5 or 6 organisations, criminal malfeasance, and destroy the value of hundreds of millions of dollars of shareholder funds and capital as well as their businesses as ongoing concerns.

Not to mention the fact that there would still be many, many, many enterprises that would be running partial nodes, who would also be able to detect errors or malfeasance over the parts of the blockchain that they have downloaded or use within their own networks and enterprise.

The thousands of nodes contributing hash to protect the network and solve the Byzentine generals problem were necessary during the bootstrapping phase of the Bitcoin network. As the network matures the capital investment required to participate, maintain and improve the network in effect become a compensating control over the security of the system.

Do you see the difference between that and running a Rasberry Pi?

lolololololololololololololololololololol

but the whole bitcoin chain was going to be modified by hundreds of thousands of participants or more all for one guy…

presumably that will be a very short list for your proposed “solution” say 5 or 6 people. probably less than you claim are controlling bitcoin.

The miners don’t control Bitcoin – they are neutral transaction processors. They aren’t going to be people either, unlike ETH 2.0 PoS system no individual is likely to be able to afford the hundreds of millions required to set up and run the server farms. They will be corporations like TAAL who invest millions in infrastructure and will be governed and accountable by public boards:

https://coingeek.com/taal-announces-marketed-public-offering-up-to-40-million/

Miners can’t change the protocol, they can’t hide information, the only possibility is that 3 or 4 of them collude in order to do what you are suggesting, which would then destroy the trust in their systems and the hundreds of millions they have invested in their businesses.

If there is any likelihood of blockchain technology being adopted by financial institutions then there is zero likelihood of any individual being involved in transaction processing. Institutions won’t touch it – it will be controlled by corporations, their governance boards and regulators.

Can you point me to the math – I think I pointed out the storage costs were next to non-existent, in regards to simple transaction storage info as opposed to raw data warehousing.

Here is an interesting thread on how that is developing:

https://twitter.com/BigBlockTesters/status/1367134120434946053

That is in reference to a big block test event scheduled for 13th March, so that should give some indication of problems in the data storage space, but raw transaction storage is really a non-issue.

again deliberately obtuse.

Raw storage cost is not a problem for a centralised storage system. Like mastercard.

It is for a decentralised system, like bitcoin. because it is size x number of copies.

It really seems that you want to ride the decentralised bandwagon with a new mastercard equivalent.

Like mastercard currently does on it’s servers for a fraction of the cost. Because it isn’t indelible just because it’s a blockchain. As you loved to point out previously in this

No, being obtuse is saying something can be done – Mastercard, and then can’t be done – distributed across various server farms.

You:

At current transaction rate it chews up a large portion of a desktop computers drive, at 10x current rate it probably wouldn’t fit on a current desktop machine. That isn’t very practical for a public ledger.

3Gb X 144 blocks per day = 432 Gb per day

x 365 days a year = 157,680 Gb per year.

Where are you planning on storing the blockchain?

Me:

I understand Gb storage is around $0.02 or 2c per Gb – is that correct? If so then it 157,680 Gb of storage would cost about $3k per year?

So are you saying that only Mastercard could afford $3k a year on storage?

Edit: It is indelible, there is a record of the transaction going in to an account and there will be a record of the transaction going out when it is re-assigned. The transaction chain isn’t broken it is recorded publicly and indelibly for all to see.

This has been interesting reading. I own that I never paid attention to the block size wars at the time and never bothered to look into the controversy subsequently. Peachy be lazy.

But I feel that the above has served as a very basic primer on the issues. So thanks.

Having read what’s above, I’m feeling inclined to bjw’s explanation… I can’t run a Bitcoin core thingy on my Mac if it needs 157,000gb. And that much more every year.

Sure MasterCard or IBM can, but that’s not “trustless” anymore.

The purpose of multiple nodes was most important during the bootstrapping phase as one of the filters designed to solve the Byzentine Generals problem.

Long term it was envisaged that most of the processing would migrate from PC’s to server farms, and the substantial investment in infrastructure by miners would act as another filter designed to ensure honest mining:

BTW – you wouldn’t be able to mine anything on your Mac at the moment other than maybe some Doge coins. To have any hope of mining anything you would need to invest in very expensive Ant miners to solve the hashing algos.

Again deliberately obtuse, or you really don’t understand any of this very well at all.

You don’t need to mine to be able to verify every single transaction on the blockchain. you need to be able to store the entire blockchain.

I haven’t mined bitcoin since 2013 or so but have run a node since then and still do.

That quote is nice but I really think you know not what it means.

I was mining on my pc on a graphics card, but that has been replaced by “specialists with server farms of specialized hardware. ” not A specialist with a server farm, or a couple of specialists with a server farm each.

In fact it perfectly describes the current bitcoin ecosystem.

Tell me I’m obtuse and I don’t understand it again you fucking retard.

Running a fucking node is IRRELEVANT for the security of the overall network, it is a fucking nonsense that dummies, like yourself have swallowed hook, line and sinker.

Your Rasberry Pi adds NOTHING, your hash adds NOTHING, it is 2/5ths of fuck all of less than 20% of the total hash.

You may as well be pissing off the edge of dam and looking down the valley and say to yourself – “I’m irrigating that”.

I understand PERFECTLY WELL that in order to mine transactions you need to be able to store the entire blockchain, and it will – ultimately on 5 or 6 server farms.

Do you understand – sufficient security is gained through 5 or 6 commercial miners, competing with each other and risking the hundreds of millions of dollars they’ve invested in the system to process thousands of transactions a second.

It isn’t secured by some nerd sitting his room running a node and contributing microscopic amounts of hash to secure a system that can only process 7 transactions a second.

Stewie,

You are the one who simply does not understand WHAT A TRUSTLES SYSTEM IS.

So since you are so smart please tell me how i know the miners aren’t changing the blockchain behind the scenes?

Or don’t if you don’t understand it, you fucking retard.

Do you understand that this is a self defeating argument. Paypal and mastercard and the banks are secured by exactly the same thing, have first mover advantage and lower processing and transaction costs because they don’t have the blockchain overhead, and also have brand recognition. So good luck with that.

edit:

I can’t help but feel you have been conned by the proponents of this system given your rather aggressive response to some facts.

I’ve explained it MULTIPLE times to you already, but your are too OBTUSE to get it.

I will repeat it one more time because you appear to be slower than a Rasberry Pi:

It is only necessary of 5 or 6 independent miners to store the entire blockchain. There would still be thousands of other businesses would would run partial nodes and store parts of the blockchain, relevant for their enterprise. They would be just as likely to detected malfeasance on the parts of the chain they run and refer to as miners.

Good luck publicly reviewing Mastercard or Paypal systems if you wanted to – they’re not public and they’re not trustless to the same extent that a public blockchain offers.

Edit: It isn’t the discussion of facts that has elicited the aggressive response, but the constant reference to being obtuse in what was otherwise a good faith conversation.

Stewie, I know there is only an infinitesimally small chance that I coul mine any BTC these days and that’s ok 😀

It seems to me that you give too much credit to Nakamoto – he might have had his views. But he may have been wrong. Or at least his views have been proven suboptimal* in the real world. You can’t always point to what that guy thought as an eternal truth. He is fallible…. or at least should be assumed to be so, given that everyone else is.

*”optimal” obviously has many dimensions – legal, technological, cultural, economic… all from the perspective of the particular time and place when forks (haw haw, see what I did?!) in the road were arrived at and decisions need to be made.

the quote attributed to Satoshi describes the current bitcoin system perfectly. It really doesn’t support stewie in the least, and neither do the other quotes and references to the white paper if you actually understand the system.

He/they may not be infallible but the more I understood about bitcoin the more I appreciated that for every compromise they had to make they chose the option most likely to lead to success of bitcoin. History has proven that they were correct. It’s pretty easy to claim this and that while riding on the coattails though…

…and yet the system proposed under the White Paper works and companies are investing hundreds of millions of dollars in that system.

https://coingeek.com/taal-announces-marketed-public-offering-up-to-40-million/

The purpose of this article wasn’t to delve into the technicals of BTC or BitCoin, it was to provide some history, context and insight into who controls the BTC network.

I don’t deny the changes made to BTC compared to the White Paper, indeed I think it is important to point them out and show were the differences exist and how that effects the outcome of the system.

The BitCoin White Paper IS the Truth in terms of how the system known as BitCoin was designed to operate. Does BTC operate according to it today – Hell no, that is why it isn’t BitCoin in anything but name.

I never said it can’t be done on a server farm.

I SAID DOING IT ON A SERVER FARM IS NOT A TRUSTLESS SYSTEM.

And we have far better ways of doing it on said server farm.

So actually I guess it depends on what IT is. If it’s trustless, then actually NO you can’t do it on a server farm.

The transaction is trustlessly settled – holding and storing OP_Return data will depend on individual miners maintaining the data. I will agree that the data, seperate from the transaction record, will to some extend require trusted third parties to maintain – for which they will be paid a fee to store.

As an unrelated aside, I just realised that my “Bitcoin is a Bubble” article was pushed out on the very day that BTC managed it’s all time high!

Whether this remains its ATH in the current bubble remains to be seen.

Blokes – can I test my thinking with you. I think the disagreement between you (and btc/BSV) is really about which bits of the structure are public and which are private.

In both cases, we can say there is ultimately going to be too much data for the blockchain to live on people’s private computers. But:

1) With BSV you’d have a fat heavy chain. So fat and heavy that the beginning of it would be held somewhere in a private/centralised location & the public would just play with the tip to which née blocks are added.

2) with BTC you have a thin light chain, which the public could have copies of in its entirety. But then you’re looking at private/centralised solutions to deal with big chunks of new data being attached at the tip (or to the sides) of the chain – such as the lightning network.

Right?

Essentially that is the difference between big blocks and small blocks.

BSV you would end up with 5 or 6 miners running full nodes, thousands of businesses running partial nodes and various organisations storing data (which may or may not be miners). I’ve pointed out an explained above why I don’t think this is a big issue compared to the reality of how the existing BTC network operates, others think differently. That’s cool, that is how we make a market.

BTC you end up with a thin chain, were it is hugely expensive to transact on the chain, and most of the transaction activity is pushed off to private side chains with more fees and ticket clipping along the way – this is essentially the model that already exists for BTC and its not going to get any better. Under this model virtually no P2P or microtransaction activity will take place here, or on any side chain, it will mainly be used as a settlement layer by private networks like Lightening or exchanges to settle across, like a convoluted swift network.

This article wasn’t written to argue the technical aspects of BTC, I wrote it simply because I saw a meme involving Mastercard and thought some people might be interested in having that explained to them. BJW obviously knew all of that as rather than commenting on that he’s been rabbiting on about all these things BitCoin can’t do, yet which are actually being done on BSV right now.

I would be delighted to have BJW produce an article on all the technical reasons why BTC can’t scale and provide and link to all the evidence to support his views, as I have done.

Well, I benefited from having it explained to me (https://www.ezfka.com/2021/03/05/btc-is-the-establishment/#comment-896), so didactic purpose ACHIEVED!

I don’t think that either approach is better or worse, per se. And luckily they can both co-exist (technically).

Maybe in practical terms they can’t both coexist and must fight to the death. In this case we must expect a dirty fight and the winner will not necessarily be the more technically admirable (or satoshi-pure) implementation. That is just life.

Yeah – ultimately I agree that it is a fight to the death, and to be honest I think it is far from certain that BSV will triumph, even though I believe it is the superior technology. As I’ve outlined in this article, it has very powerful vested interests opposing it, who recognise the threat it posses, and are doing their best to kill it – and they may well yet succeed, the odds are staked against it. I’ll freely admit it.

I’ve pointed out the short interest against it, here is a good thread on it:

https://twitter.com/happy4kappy/status/1366141204178612226

It is THE most shorted crypto out there 84% short and these shorts have been maintained all year in a flat market, the carry costs would be costing them a fortune. A trader would be frog marched out the door if he carried a short that large for a whole year. They are simply not economic shorts, they are strategic shorts to punish BSV investors and discourage activity on it.

My investment criteria prevents me from investing in known scams or where there is a non-linear risk of failure. I’ve stated that I believe the majority of BTC’s current value is due to Tether manipulation, when it goes, and I believe it eventually will, the carnage will be enormous.

To be honest I thought as BTC boomed, some of it would rub off on alts, like they did in previous booms, and they largely have. What I did not consider, and a genuine error on my part, was not considering that if you could print money you can effectively move the price of any asset up OR down. When you pay your bills in the USDT you print, then paying your carry or cash/USDT settled futures it isn’t a problem.

The other alternative to the shorts is that they have been put on by MasterCard or AXA, although I think this unlikely. If the short interest remains after Tether eve gets taken down then I guess we’ll know.

The other thing is, if BSV is such a failure and a scam – why go to such effort to kill it? Why delist it from all but 28 exchanges? Why has Bitfinex, one of the most hostile exchanges towards BSV maintained its listing when virtually every other major exchange has delisted? Maybe because it runs cash settled or should I say USDT settled futures against BSV?

As I said, if BSV is so doomed, such failed technology why go to so much trouble to kill it? Why not just let it wither and die like any other number of chains?