Yield Farming – heard of the term? How about DeFi? Apparently it is the future of finance, but do you really know what it means? I was asked what they were the other day and by now I’d sort of worked out what they referred to and was able to provide a basic explanation, but it wasn’t always the case.

For a long while these terms puzzled me, I could get the sense of what they were about and how they worked, but the details and mechanics eluded me. I knew they operated on other blockchains (primarily ETH), but being a BSV maximalist and not prepared to pay ridiculous transaction fees in order to use the networks they were hosted on, they remained something of an enigmatic mystery to me until I eventually inadvertently stumbled into one and without realising it become a yield farmer myself.

As to the original question, Yield Farming and DeFi? I’ll start with the second one first. DeFi is just the short name for ‘Decentralised Finance’ which is the all encompassing name for the industry or notion that all the traditional financial instruments in our existing financial system, can be recreated on a decentralized basis using the blockchain architecture and thereby bring about immense efficiencies… although in the extended cyber punk version those, imho flawed, beliefs that DeFi would also remain outside companies and government’s control.

The reality is that DeFi is unlikely to bring into existence another legal structure to compete with Companies. This is because the characteristics of most DeFi projects can if not already fall under the description of being a Company, otherwise be caught under existing legal definitions of a partnership, limited partnership, loan, annuity or some other such combined legal undertaking for which rules already exist. As with my scepticism in regards to Crypto or BTC being censor and government resistant, I remain very doubtful that DeFi will deliver the cyber punk dream of creating a newly defined legal entity or escape the hand of government i.e. the Law and especially taxes.

Yield Farming on the other hand is a subset of activities taking place within the DeFi space, that involves the of staking or lending of crypto assets in order to generate high returns or rewards in the form of additional crypto currency. The premise is that liquidity providers are incentivised to “stake” or lock up their crypto assets within in a smart contract-based liquidity pool, to act as a form of working capital that allows the pool to undertake some commercial business activity – making a market and trading for instance.

The DeFi nature of these cyber constructs is that they are largely automated and all the activity take places and is recorded on the blockchain. Basically the pools have various rules that limit the size of trades that can be put on, in order to limit the risk to the insurance pools (‘impermanent losses’), spread risk among farmers, etc. All designed to essentially mitigate risk – although one of the biggest risk with DeFi projects has been founders setting up a secret backdoor that they can then use to drain all the pools funds.

One of the oldest examples of DeFi in the crypto space is Uniswap. This is an automated protocol that runs on the Ethereum blockchain that facilitates automated transactions between various ETH cryptocurrency tokens basked on the ERC-20 token protocol. Uniswap uses liquidity pools, mainly consisting of “ETH” coins that users or ‘yield farmers’ have ‘staked’ to enable the protocol to perform the role of a market maker. Although it was only created in November 2018, by October last year the average daily trading volume was $220m and by March of this year was generating fees for all liquidity pools of between $2m to $3m daily.

However as the popularity of DeFi applications like Uniswap have grown, especially those hosted on the Ethereum blockchain, the limitations with ETH’s ability to scale has started to impede on the efficiency and cost of transacting in these swaps and pools, via network congestion and high fees, has become more and more apparent. This has resulted in other DeFi projects being launched in competition on other blockchains, Cardano, Avalanche and especially Binance coin.

As these projects came online over the past 18 moths there has been a veritable explosion in DeFi as a use case across the crypto space, first really beginning in March of last year and then really commencing to accelerate through August 2020 and into this year, correlating with a large portion of the Crypto markets overall upward movement.

My own experience of DeFi and how I stumbled into becoming a ‘Yield Farmer’ was with the arrival of smart contracts commencing on the BSV blockchain – essentially the original BitCoin protocol before Core removed most of the features that enabled all of this sort of activity to take place on it, and which in turn spurned the creation of all these other competing blockchain products.

Tired of just HODL’ing BSV and with an explosion of activity starting to take place on it, I came across a new decentralised exchange, TDXP, being launched on BSV which had a wide variety of products, not just of crypto, but commodities, stocks, indexes and FX. Essentially TDXP was launching as a decentralised CFD provider, where the users bet on price and take possession of a CFD as opposed to taking possession of the underlying physical (a strategy that many crypto exchanges, decentralised or not, have started to pursue). As the exchange was new and seeking to increase the bets that users could put on, they also offered opportunities to invest in the various liquidity pools offering guaranteed returns for ‘staking’ coins. The guarantee was higher for initial small investments, and tapered off for larger investments made later.

Currently I’m earning around 13% pa on the total cumulative amount that I have staked – a return which I am comfortable with in terms of the small amount that I have staked, and also in respect of it not being so unrealistically high that I fear I have bought into a blatant debt pyramid or barely disguised ponzi.

Okay, so that is essentially what DeFi and Yield Farming are about. So what are the advantages over other more conventional finance and CFD bucket shops?

The biggest advantage as a DeFi product user is in regards to credit risk. If you are entering into a smart contract there is very little credit risk – you are not sending your money to someone like Robinhood to hold. Consequently you are not exposed to the credit risk that Robinhood represents if it suddenly goes bankrupt, in which case your trading account with them would instantly transform you into an unsecured creditor. With most of these DeFi products you enter into a trade e.g. bet on price of BTC/USD. The margin associated with that bet comes out of your own personal crypto wallet and is held in escrow on the blockchain until the conditions of the smart contract have been met, or you cancel or end the trade, after which the coins you staked as your margin are either returned to you wallet plus any gains or losses.

Credit Risk should not be under-estimated, and it is in this area that blockchain technology could have some of the biggest impacts in the mainstream finance space.

When most large financial institutions enter into derivative contracts with each other, they are required to stake collateral with each other or with clearing houses. This collateral is used to mitigate the risk of loss to the counterparty, should you yourself go broke. However the staking of collateral itself also creates a credit risk, being the risk that the person holding your collateral goes broke and you effectively become an unsecured creditor (so much of financial plumbing is a daisy chain of credit and liquidity risk).

Consequently banks and financial institutions are required to take a capital charge for collateral that they stake to mitigate the perceived credit risk, by reducing the amount of shareholders capital that they can deploy to other projects, like say lending to borrowers. As shareholder’s capital is the most expensive form of capital for corporations, this can be a big expense to banks and financial institutions, and one of the advantages of a blockchain is that theoretically collateral that is posted in a smart contract to the blockchain in satisfaction of collateral obligations, is effectively devoid of counterpart risk or credit risk, and thus conceivably it is possible to reduce capital held in reserve to mitigate non-existent credit risk.

There are also theoretical savings in terms of processing and transaction fees, in that a whole swath of middle men are removed from the plumbing aspects of how these financial markets operate and the overheads that they must support. However as we have seen with ETH, while there may be savings in that respect, often the congestion charges that arise from using on a non-scaling network end up more than offsetting these gains.

Now for the problems and risks.

The biggest risk I see is the fact that the value in these volatile coins that are staked in these schemes, serves as the working capital for these DeFi projects. That means that their ability to pay out their smart contract obligations depends on the value of the underlying ‘staked’ coins, such as ETH, ADA or BSC all at least maintaining their value and hopefully rapidly increasing.

If there was a market disruption and say the price of these coins fell by 50% then that would wipe out 50% of the working capital backing these DeFi projects, while the obligations in respect of the smart contracts requiring to be paid out could conceivably move in the other direction. Now there are are various ‘insurance pools’ and rules to socialise losses like impermanent losses, that are meant to mitigate these risks, but the fact is none of these DeFi projects have yet been tested through a severe market correction that have frequently been a feature of the crypto space, where price falls of 80-90% are not uncommon (especially for the alt-coins).

The other issue is the nature of ‘staking’ coins is itself a self generating liquidity tightening event. Essentially you are removing coins out of the market in order to have them tied up in these smart contracts, which helps to contribute to tighter supply and higher prices in the underlying coins being staked e.g. ETH.

So while DeFi is currently (or has been) in a virtuous cycle, as HODL’ers have found a means to earn some money other their leaving their crypto stash under their cyber bed, it has helped drive the price higher as other crypto users also sought to buy into the DeFi craze and become yield farmers themselves, and found fewer shares coins to buy. Another compounding problem is that most of the chains on which this DeFi activity is taking place are already fairly liquidity constrained markets, with the original founders who established these chains still often holding most of the overall coins in the market.

Consequently it is hard to determine how much of the boom in alts like Cardano and Avalanche or the like is the result of genuine demand and usage or FOMO being driven by sky rocketing prices in an increasingly liquidity constrained market, that is seeing coins bought and the removed from supply as they are “staked” to various DeFi projects. In my opinion the risk is that there will come an event that throws this whole virtuous cycle into reverse and the whole market seeks to unwind at the same time, or that somewhere in this daisy chain of leveraged risk, something will blow up. It is for these reasons that I’ve refrained from going ‘all in’ on DeFi, until I see how it all performs during a market sell off – Warren Buffet’s words of it only being when the tide goes out that you see whose been swimming naked. I suspect there are lots of nudies in crypto.

Finally there are specific issues with the coins or blockchains themselves. As I’ve mentioned previously Ethereum, as a state based blockchain, simply can’t scale in any meaningful way, and as the popularity of DeFi has surged on that chain it has become increasingly crippled by high transaction costs. This effectively ends up making many of these DeFi transactions on ETH far, far more expensive than the cost of doing a similar trade a conventional exchange like Robinhood. Other chains like Cardano and Polkadot have other issues, but some do provide a superior cost platform compared to Ethereum in which to transact on.

Finally there is the current market golden child, Binance Smart Chain, which has tokens on it delivering truly ridiculous returns of up to 5378.21%!!

Honestly these sort of returns are both truly unsustainable and about the biggest warning sign possible of leverage built on leverage, built on ponzi’s built on ponzi’s. I’ve spent some time trying to understand how these returns are possible and that is the best explanation that I’ve been able to come up with, I’ll try to illustrate what I mean.

But first a couple words on Binance. This is imho one of the most dodgy exchanges in operation with probably the highest credit risk in the market. It’s founder Changpeng Zhao, started it in China and then progressively relocated around; first Japan, then HK, then apparently Malta, then honestly who knows where? The reality is CZ currently lives out of a suitcase with no one quite sure where he really is, as he scampers around the world to stay just out of reach of authorities. He is a China exile following his branding as a “pro-bourgeois” intellect and has been named in a lawsuit against Binance alleging that Binance is involved in facilitating large scale money laundering.

Binance also plays a significant roll in the Tether Ponzi, in that it allows Tether to be used as cross collateral for BTC. Binance users can “stake” their BTC, which has high transaction fees or whose sale might trigger CGT events, for Tether, which they can borrow for 0% interest and then use to purchase other cryptos, like…. BNB or Binance coin (more of this later).

If you check out the BTC traded volume on a site like Bitcoinwisdom and compare it to the last boom that occurred in 2017 you’ll notice that this boom has taken place on much, much lower BTC volumes. This has been part of the reason – BTC is being bought up and ‘staked’ for Tether, and then on traded into other cryptos. So the same dynamic with DeFi staking reducing liquidity is also at play in the BTC market.

But back to BNB, BSC and all the various BSC tokens.

BNB is Binance Coin and was launched in 2019 to facilitate fast, decentralised trading on Binance’s decentralised exchanges. With limited liquidity in the face of rapidly rising demand (using the coin delivered perks like lower exchange fees) and an industry tendency to HODL, meant that BNB rapidly appreciated in price. However while BNB was a state based or ETH style coin, it was a bare-bones network that focused on transactions speed and sacrificed broader utility like smart contract features which can’t be performed on that chain.

Enter BSC or Binance Smart Contract in 2021, which is a new Binance blockchain that runs in parallel to BNB and which as the name implies, enables smart contract activity to take place on it. Furthermore BSC is a PoS chain, or a “Proof of Stake chain”. Specifically it uses something called ‘Proof of Staked Authority’, where participants stake BNB in order to become validators of BSC!

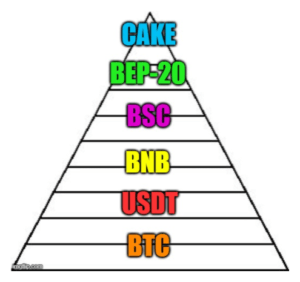

So BNB is essentially the first layer of DeFi pyramid – note that BNB is also not an inflationary blockchain, no more coins are supposedly being made, so while there is the ongoing transactional demand to facilitate trade on Binances DEX changes as one of the base transactional pairs eg BTC/BNB, ETH/BNB or USD/BSB, there is now an additional incentive for crypto enthusiasts to buy BNB and then ‘stake’ them as BSC validators, effectively removing them from transactional liquidity and placing upward pressure on price.

Next is BSC itself. Just as with ETH being staked as the base coin to provide the liquidity in all the DeFi activity taking place on the ETH blockchain and the various ERC-20 tokens, so too are holders of BSC encouraged to stake their BSC in the liquidity pools to enable trading to take place on the BSC blockchain and the various BEP-20 tokens that it hosts. This is the Second layer of the DeFi pyramid and just like with BNB, the staking process encourages more liquidity being withdrawn from the BSC environment as those coins are staked in various liquidity pools.

Then there are higher levels of the pyramid, distributed apps (called DAPPS) where the trading takes place – Pancake Swap or Bakery Swap – which are essentially the Binance version of UniSwap. But it doesn’t end there, there’s more! You can also farm Pancake Swaps Governence tokens, called CAKE.

Thinking about this some more and going back to the start, arguably the first layer to all of this is BTC which as I mentioned is cross collateralised to Tether. Tether is then used to purchase Binance coin BNB, this is important because BNB is a non-fiat operating exchange – Tether makes it possible for Binance to exist. BNC is then used as POS for validating BSC, 3rd layer down, then there are there all the BEP-20 tokens including CAKE, 4th layer down, and finally there are is the Crypto Industry version of CDO’s squared, which are tokens specifically designed to jump from yield pool to yield pool, eking out the best possible return.

Honestly the scammy end of DeFi has more layers down than Chris Nolan’s film Inception. Is there any real value being created? Frankly I doubt it – I just can’t see where the value is being created. To me it has the appearance of speculation built on speculation built on speculation, being carried out on top of one liquidity constrained market after another. When you peel back the layers on which most of these chains are being carried out on, there is virtually no real world work being done, and in my view it is all going to end in tears.

Whether it simply be a market unwind of the current boom or a systemically important player like Tether or Binance being taken down, just like Inception at some point people are going to realise that all this ‘wealth’ is simply just a dream.

*Disclaimer: This is all in my honest opinion (IMHO). I am far from an expert on these matters, and while I’ve tried to make a fist in understanding the flows, by no means I am over everything.

Not all of the DeFi space is scam – I’d love some further insights from other people interested in this space, as there are some solid commercial projects on other blockchains – especially Ethereum. But while there are some legitimate DeFi projects being built on all the blockchains, there are some absolute scamcoins too – Mooncoin is another example imho.

With regards to Binance(s) coin, I really, really tried to understand what is going on there, and while I am certain most of the enterprise and trading that operate on top of it are legit, the problem I have with it is the market structure and pyramid of inter-related liquidity risks and dependencies that I described.

Anyhow, if there are any other DeFi users or farmers out there in EZFKA, please tell me of your experiences below!

Culture yields toxicity as overgrowth

Also fuck you punk motherfuckers!

2/169 Latrobe st

Melbourne 3000

0497646933

Lets fucken do this

Make love, not war!

This is a phenomenal article! I’m going to share it around.

Thanks T – glad you found it informative. They’re terms that that I wasn’t too sure about 6 months ago, and that was my best attempt to explain them as I’ve come to understand them and the risks and drivers in that “industry”.

One of your longer pieces Stew. I read part way and had to stop because I read this:

so this is something I can actually do? Today? Go lock up some BTC somewhere and get a 0% advance of USDT that I can cash out?

Are you sure it wasn’t just because your eyes got tired?

There are some conditions to that statement. Firstly I’m sure you’d have to keep your crypto within the Binance sandpit and not send it out to some other exchange and secondly, I think the offer might be limited to some products:

https://www.binance.com/en/blog/421499824684900480/Everything-You-Need-To-Know-About-Cross-Collateral

“46 DeFi projects on the Binance Smart Chain have exit scammed in the last month alone.”

https://twitter.com/CryptoWhale/status/1387271810471825410

My non-surprised face.

ah, I was afraid that there’d be catches 🙁

My peachy mind had already mocked up a nice rehypothecation racket – lock up 1 btc & borrow its value out in Tether.

use this tether to buy another 1 BTC.

lock up that new BTC & borrow its value out in tether.

use this tether to buy another….

Of course this doesn’t work if they only really allow you to collateralise futures positions with your assets, rather than giving you a real loan :/

There are some DeFi Co’s that will give you a real loan – Celsius network for instance.

https://celsius.network/

Interesting.

looks like an almost pure asset lending model. With 25% LTV, they’ll give you a 1% interest rate.

If they grow a bit and get to the point where they can do this at 50% LTV, they’ll destroy the Aussie banks. CBA eat your heart out!

I would like to see how their model works through a typical crypto correction.

Yeah I thought the same…..

Thanks Stewie

I’ve been holding BTC for a while. HODLing is all well and good but cashflow is very nice.

I’ll try to read all this but not sure I can make it

can you give a TLDR?

how is loaning magic beans to other magic bean enthusiasts generating actual productivity that manifests as profits

For many, not all DeFi projects there exists a daisy chain of inter-related risks, on various liquidity constrained coins, undertaking business activities that encourage staking of coins as a fom of working capital. A side effect is that this act removes coins from circulation and can tighten supply boosting price.

There are many coins and blockchains specifically designed to take advantage of this relationship/effect, eg Mooncoin, and serve no commercial purpose other than to facilitate a run away liquidity constrained ponzi.

How does staking remove coins ?

in the examples I’ve read, people “stake” USDT and that USDT is then used to buy a different crypto

in that case the USDT is very much still in circulation ?

the coins are not static, only the debt obligation created

also, are the “coupons”/yield paid out in fiat? Or in the same coin that was “staked”

thanks

It encourages more people to buy coins to effectively HODL in DeFi liquidity pools, removing them from available supply. The ‘yields’ are paid in crypto coins and often re-invested or re-staked. USDT is frequently staked as well, removing it from circulation too.

Can you explain how “staking” removes coins from circulation though ?

if they’re removed from circulation, what utility is the person borrowing them getting ?

in this case they would be paying the coin owner for nothing other than no one being able to exchange the coins

which makes no sense

thanks

Sure – take the one I have invested in TDXP, which is effectively a decentralised CFD provider.

The coins I’ve “staked” have gone into a liquidity pool that provides the liquidity “depth” that allows TDXP to operate a market, effectively taking the other side of ‘bets’ placed by traders on the price of an array of products ranging from other cryptos to Apple shares.

These bets are currently settled in BSV, however there are plans afoot to enable traders to make these bets in BTC or USD, in which case they will be paid out in BTC or USD too.

Currently the liquidity pool for TDXP 21,444 BSV which represents about 0.1% of all the BSV that will ever be mined, or 0.12% of the coins that have been mined so far (around 18.5m).

However, BSV liquidity is much tighter than that, the effective market liquidity is thought to be only around 6m coins, as many coins have never moved and a large number of coins have never been split from the BTC or BCH chains they are ultimately connected to. Thus those coins tied up in the TDXP liquidity pool actually accounts for 3.6% of all the available BSV liquidity.

Sure 3.6% may not be a lot, but if you suddenly got 10 or 20 DeFi projects on the BSV chain that required 20k BSV coins each, suddenly you’ve gobbled up 36% to 70% of the available market liquidity, and the price would presumably sky rocket.

Relative to a lot of other coins, BSV is much more diversified in terms of ownership. Some coins, have as little as 30% of the total available coins in the market – the rest are held by the founders or associates, so the demand, as you noted creates a self full-filling feedback loop – which I suspect once the price gets high enough, will see the founders start dumping the coins as they exit scam.

This is part of the reason why so many ‘Alt-coins’ have suddenly gained so called market capitalizations of billions of dollars.

if this is the case then they are certainly not out of circulation

you’ve explicitly said they are being used to provide liquidity ?

which one is it – can’t be out of circulation but also be providing liquidity at the same time

Unless there is a disaster and all the trader’s bets pay off, and all the socialised loss rules etc fail, and all those coins have to be paid out, then 99% of those coins will remain in the pool simply providing liquidity within the betting market.

If you wanted to buy BSV for whatever purpose, then they’re not available in the circulating supply to meet your demand – they’re effectively being HODL’ed, as they don’t form part of the circulating pool of coins.

Ok so they’re not being used to provide liquidity then

so what are they being used for ?

that is my question

You have handed over your 100 BSV to TDXP

TDXP holds them in their wallet

TDXP then shorts BSV by selling an option to someone else to purchase at a later date ?

the purpose of them holding your BSV is so they aren’t naked short ?

is that what you are suggesting ?

I think that’s extremely unlikely to be honest , as this is a completely unregulated market so why not just naked short sell instead of paying you 13% pa

but let’s assume that it’s true – the liquidity isn’t reduced, since TDXP is selling covered options to provide liquidity

its really no different to coins on an exchange , which are essentially held in escrow by the exchange as well

none of this is conducted on the blockchain, and none of this has any regulatory oversight

now ask yourself why would TDXP pay you when they don’t have to

and how do these hedge funds derive profits in aggregate in order to provide aggregate returns to all “investors”

Most CFD providers operate on the assumption that 70% of all traders lose. The purpose of the liquidity pool is to ensure that the winners are able to be paid out – the liquidity pool is essentially the working capital that sits in reserve to enable them to accept bets within a range that they can pay out on the basis of probablilities.

The blockchain enables auditability, so you can check that the coins exist as the hot and cold wallet information is visible:

https://whatsonchain.com/address/1ShMZrP92s1bFMfrpTMGFwWYyeX9cG1aN

https://whatsonchain.com/address/1CA8MPFLvNhZr6CBgUTovcDtbHN48SnNu2

The company maintains their own servers which interface with the ledger. Every transaction is recorded on the chain and you can check the prices and transaction amounts, and back solve in order to reconcile them with the transaction details recorded in your account and which you would be able to verify with your own record keeping.

Other examples would be with online gambling – the randomly generated seed number can be included in the transaction as part of the OP_RETURN. These are easily auditable, Regulators perform significant testing over the true randomness of these numbers, and the numbers are stored publicly.

People are buying options, not the coins

so there’s no way for anyone to check how many options they have written

in any case, it’s a form of liquidity

From what I can gather this is a ponzi within a ponzi

users “stake” their coins – an unsecured loan

borrowers take those coins and use them to buy other crypto currencies , in the hope of making a capital gain

the act of removing coins from circulation (though I don’t think they ever really are removed from circulation, is that correct?) in addition to the speculative buying of other coins , creates an uplift in prices which creates a self fulfilling feedback loop

at no point is anything of actual value created

this isn’t used to purchase real assets or employ others to create real goods and services

have I got this correct so far ?

or am I misunderstanding

That is pretty much it – with the Binance family of coins and Dapps being, imho, a pyramid of leverage across a series of liquidity constrained coins. While it is a more extreme example, this effect is applicable to some extent across all the coins, starting with BTC and Tether, as the base layer to this whole game.

That said there are a small number of legitimate DeFi products and businesses across a couple chains, which do have viable business cases and real world value/use, however even these haven’t been stress tested by a severe market correction.

By and large most of the space resembles a ponzi built on a ponzi built on a ponzi.

I’ve wasted many hours of my life understanding each new crypto “technology” , only to realise that each of them is simply an increasingly convoluted ponzi

an inception of ponzis

could you please in future just spare me the time ?

Commo, I think you’re doing it wrong.

all these crypto things are basically spreadsheets.

BTC has gone in and grabbed cells A1 – Z200 or so. All that most spreadsheet users want to do can be done in those few (5,000 or so) cells. So they’re the most valuable.

all the other crypto coins are like the far cells… like CB680, say. Yes you might need them if you’re trying to spreadsheet something really geeky and niche, but most no one wants to go there.

So they’re less valuable.

Yet other crypto coins are like macros and advanced formulas and shit that nobody normal understands. So they’re even less valuable.

So beyond the couple of mainstream type crypto assets, most things are esoteric solutions in search of problems. There’s an off chance that a suitable problem will be found, making the solution valuable…

Yes I’ve understood it precisely

it is exactly like an excel spreadsheet

and I can just press ctrl-n to start a new spreadsheet and grab whatever rows and columns I feel like

in fact I can do this essentially for free as many times as I like

only some people think my Untitled2 is somehow not as valuable as their Untitled1 document

except their spreadsheet is so crammed it’s running out of memory and takes hours to make edits , whereas mine is running fine

but theirs is still worth billions of dollars more than mine

somehow

Who knows why it’s like that. It’s not a technical reason, surely.

People want what others have, not just what is good. We see that in land, obviously. But other arenas too.

it’s psychological, I guess. But I don’t claim to know much about psychology.

Yes

it’s psychological very similar to tulipmania

except bitcoins aren’t even pretty to look at

it’s a mass shared delusion

still im glad Bitcoin has at least dropped the pretence of having some actual utility , while other crypto waste my time by pretending to have some

Covetousness be driving it? Maybe we can launch a COVETCOIN for guaranteed success?

I reckon Bitcoin does have utility…. just not as much as some might like. Some might like to be able to send a Bitcoin for a penny and to be instant, but it doesn’t do that.

It costs 0.0005 BTC and takes 20 minutes.

there are other things that cost less and are quicker to send. Like SMS and email. But they don’t carry value with them like BTC does.

if you want the benefit, you pay the cost….

can you please just acknowledge it doesn’t do anything

and that’s fine

but don’t gaslight

But it does. I’ve used it and it works.

now, I can’t tell you that what it does is worth (or needs to be worth) $40,000 per unit. But it works.

What worked was your computer , miners computers and the internet

Well yeah, but you’ve also described google, faceblog, ebay….

reductio as absurdum.

reminds me of all the economists who ignore “money” as if it’s a perfectly neutral/transparent thing.

Google, Facebook, eBay generate profits from selling services to companies that produce products or services

they take these profits and distribute them to shareholders

owning a Bitcoin is not equivalent to owning a share of the service provided by the Bitcoin network

the service is provided by miners and network computers and the electricity they consume

but it’s all my computer, their computer, internet.

all they do is facilitate some kind of information exchange. As does the BTC spreadsheet.

it’s all the same!

The purpose of these coins is to act as a commodity, essentially the fuel in a closed ledger system that is used or “burned” to power transactions by writing data to the blockchain ledger, and extracted or “mined” as fees by transaction validators (miners) as they validate (mine) blocks.

As you note the miners perform a service, for which they are rewarded with a fee paid in the systems native currency for all the transactions and data contained in each block that they validate. An additional, but gradually diminishing, reward for supporting the system while it is in a bootstrapping phase is also included.

The “value” of these coins should be 100% dependent on the ‘work’ they do – i.e. the demand to write data to the ledger and the cost of maintaining the service, electricity. Miners would be unwilling to sell these coins for less than these costs, purchasers wanting ‘work’ done should be unwilling to buy these coins for much more then these values.

Everything else is speculation.

now do a valuation like that of houses!

Shame we can’t copy-paste land

You can keep subdividing land and sell it for the same price. A bit like bitcoin halving.

but subdivided land can’t fulfill the same use

but 1 Satoshi can do exactly the same thing as 1 Bitcoin

so can 1 BSV or Bitcoin xx

indistinguishable functionally