…If the EZFKA won’t come to the Glass Pyramid, the Glass Pyramid might come to EZFKA…

https://theglass-pyramid.com/

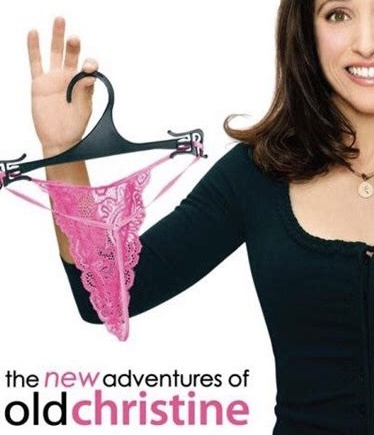

It is always touching when a Central Banker takes a moment to tell the public how much they care. It is hard not to “tear up” and reach for a hanky as the love flows. In the tweet below President Christine Lagard explains how painful it is to ask “savers” to take one for the team but why it so important to the “global point of view”. In this post we take a closer look at how Central Bankers deceive and misdirect the public as to what is really going on.

The text of her comments appear below with a few words highlighted

“I completely appreciate that people who are saving are not satisified with being charged the consequences of negative interest rates, but we have to look at the situation from a global point of view, we cannot look at a particular depositor or a particular category.

We have to look at the whole economy. And we know that by putting in place those negative interest rates we are effectively supporting the economy, we are encouraging enterprises, families, households, young couples to actually borrow at very low rates in order to invest, in order to buy their first apartment, in order to buy some equipment,

and, you now the contribution that that is in order to support the economy, in order to ensure that jobs are kept, in order to ensure that corporates can continue to operate and produce is clearly a trade off against some aspects that are resented by those that are only savers and are not borrowers”

Bank depositors are not “savers” they are unsecured investors

When someone “deposits” money at a bank they are not saving. They are making a unsecured loan to the bank. The bank offers you no security for your loan and if the bank runs into difficulties (i.e. because it made too many bad loans) it is unlikely to be able to repay much of your loan and you will lose your investment. In other words your money is at risk when you lend money to a bank without security.

When you are simply saving, say by stuffing bank notes in the freezer or by filling jars with coins, your money is not at risk (provided your freezer does not implode or your coin jar fall in a volcano) but you also don’t receive any return or interest either.

Calling unsecured investors in a bank a “saver” is very important to the Central Banker deceptions because calling someone a “saver” implies that they deserve no return. We all know that only “investors” deserve a return.

We see Ms Lagarde using “savers” this way when she contrasts “savers” with investors and notes “…some aspects that are resented by those that are only savers..” . The importance of labelling unsecured investors in banks as “savers” can be seen if we re-read the text of her comments after substituting unsecured investors for ‘savers’.

“I completely appreciate that people who are unsecured investors in private banks are not satisified with being charged the consequences of negative interest rates, but we have to look at the situation from a global point of view, we cannot look at a particular investor or a particular category.

We have to look at the whole economy. And we know that by putting in place those negative interest rates we are effectively supporting the economy, we are encouraging enterprises, families, households, young couples to actually borrow at very low rates in order to invest, in order to buy their first apartment, in order to buy some equipment,

and, you now the contribution that that is in order to support the economy, in order to ensure that jobs are kept, in order to ensure that corporates can continue to operate and produce is clearly a trade off against some aspects that are resented by those that are unsecured investors in private banks and are not borrowers”

Once we substitute “unsecured investors” for savers, the trade-off described by Ms Lagard becomes problematic.

Why are one group of investors, especially unsecured investors, being asked to asked to accept a negative return on their investment? Why are others who are making investments (i.e. banks lending money to borrowers or companies buying equipment) entitled to expect a return (..yound couples to borrow at very low rates..) on their often safer or ‘secured’ investments but an unsecured investor in a bank is not?

Not only are bank depositors not “savers” but they are forced to make “unsecured investments” in private banks.

The problems for Ms Lagard (and other Central Bankers) are compounded if this unusual “trade-off” between unsecured investors and secured investors is made more visible because the “unsecured investors” in private banks have little choice as to whether they make their unsecured investments.

Why? Because the general public are forced to make unsecured loans to banks (in other words use private bank “deposit” accounts) if they want to be able to use their central bank liabilities (notes and coins) electronically. In Europe (and in Australia and the USA) the general public and non-banks are prohibited from operating deposit accounts at the ECB.

Allowing non-banks and the general public and operate deposit accounts at the ECB would allow a real form of saving as an alternative to hiding bank notes in a mattress or filling jars with coins. What could be more natural than allowing the general public to deposit their central bank liabilities into an account at the central bank that issued them? Naturally, the ECB would not pay any interest on the balances in these ECB accounts as they are only savings and are NOT an investment.

So when Ms Lagard talks about “trade-offs” what she is concealing is that the trade-off is between unsecured investors in banks who have litttle choice when making those unsecured investments and investors (banks) whose investments are usually secured by claims on assets (mortgages given by borrowers).

Why on earth should an unsecured investor without any real choice be forced to accept a negative return on their investment while bank investments (making loans to borrowers) are apparently entitled to a positive return?

At least Ms Lagard correctly identifies that these unsecured investors are resentful at being forced to receive a negative return on their unsecured investment.

“..We are effectively supporting the economy...”

Ms Lagard claims that this odd and completely unfair trade-off between unsecured investors without choice and secured investors (banks) who choose to invest is essential because it supports the economy.

By now it should be clear that what Ms Lagard really means by “supporting the economy”. She means that the central banks are orchestrating a massive subsidy of some parts of the economy by those ‘unsecured investors’ in private banks. By forcing those unsecured investors to accept a negative return on their investments, other investors, the banks have the benefit of cheaper access to funds for their investments.

All those bank depositors, who are only making unsecured investments in private banks because they have been denied the ability to “save” in the form of an account at the ECB and just want some electronic way of storing their central bank liabilities, are being used to provide a subsidy to the private banks.

WHAT IS THE SOLUTION

More people need to stop accepting the nonsense and deceptions peddled by Central Bankers.

People making unsecured investments in private banks in the form of deposit accounts are NOT savers and we should stop calling them that. They are unsecured lenders to private banks. They are making an investment that involves risk and are entitled to expect a return.

The general public and non-bank corporates should immediately be allowed the option to operate genuine savings accounts at Central Banks (in this case the ECB). These accounts will pay no interest but that is quite appropriate for a highly liquid account that involves no risk. This accounts can be used to settle transactions between the general public and non-banks.

If the general public wish to make an unsecured investments in a private bank (deposit money at a private bank) they will remain free to do so. Many people may wish to do this because they prefer keeping their account and transaction details in their hands of private bank data miners and away from the prying eyes of some bored Central Bank employee.

Because it is likely that a considerable number of people are likely to want to keep at least some of their money in their Central Bank deposit accounts, the banks will need to work harder to persuade people to make them an unsecured loan (aka deposit money at the bank) and working harder is likely to mean the bank will need to offer more return for the risk associated with an unsecured loan. As to what that return will be will depend on how many people are interested in obtaining a return. If lots of people are keen to make unsecured loans to banks, the banks may not need to offer much of a return to attract them.

The end result is the kind of “trade-off” that is fair.

Banks offering a return to unsecured investors who are completely free to decide whether they wish to make that investment and take the risk of bank failure or poor performance or prefer to leave their savings in the safety (and zero return) of their central bank deposit account.

Allowing the general public to operate deposit accounts at the ECA (or the RBA or any other central bank) will end the deceitful nonsense and crocodile tears that currently are the performance art of Central Bankers

I recall that a few years ago in Europe, there was a movement of savers who categorically did not want to be “unsecured investors”. Insurance companies were offering storage of any sum of cash at a cost of around 0.25%. This is what led to the effective ban of cash.

Lagarde and co really are a nasty piece of work.

ps: good to see you posting here PFH.

“Won’t someone think of the Corporations and Bankers? Who will they sell and lend money too if the we do not push debt enslavement onto the next generation?”

Great article, I particularly liked this comment/observation:

How the media, Govt, institutions frame a concept, like ‘money’, or ‘saving’ is built upon cultural values in respect to those concepts. What is ‘money’ – store of value or means of magiking in growth and getting something from nothing? What are ‘savings’ gold coins squirrelled under the bed or unsecured investment loans? Often the mismatch between understanding what something is versus the reality of what it is, is a result of a mismatch between cultural expectations.

But enough on culture – here is something else right up your alley and the role that CB’s could potentially play in alleviating this mismatch between the publics expectations of what savings are, risk free saving vs unsecured investor, through the use of central bank deposits. The worlds first official CBDC the ‘Bahamian Sand Dollar’:

https://coingeek.com/cbdc-development-is-accelerating-but-china-isnt-winning-the-race-pwc-report/

Professional services firm PricewaterhouseCoopers (PwC) has given The Bahamas’ Sand Dollar the highest ranking in a report rating central bank digital currencies (CBDC).

While interesting that the Sand Dollar doesn’t operate on a blockchain (or currently operate on a blockchain) PWC has given it high marks for usability within the commercial and retail space, and a number of other metrics.

https://www.pwc.com/gx/en/industries/financial-services/assets/pwc-cbdc-global-index-1st-edition-april-2021.pdf

Combining CBDC’s with the near costless operation of public blockchains in terms of financial grit associated with transaction costs, there will now be no technical or cost reasons as to prevent CB’s from providing individual CB deposits… other than political resistance by an economic elite that have launched at least one world war and countless regional wars, including the upcoming war with China, in order to prevent any threat to the monopoly they hold over the private credit creation process from ever emerging.

Great stuff pfh. Thanks.

I tend to agree with most of the article, but the gov/reserve bank give at least the pretence of securing these loans to commercial banks, at least for most normal people.

Participate in the asset price / debt ponzi scheme or get crushed! Great basis for a healthy economy /sarc.

Love your work Pfh! I’ve pretty much stopped visiting MB now, but for a while there I appreciated you being an increasingly rare voice of reason on that site. Can’t have been easy going against the flow of “isn’t MMT great” type of commentary and comments.

Those MB blokes have a weird sort of Stockholm syndrome.

they bitch and moan about being raped by house prices and low interest rates.(currency devaluation)

…then they cheer MMT and QE and negative interest rates. Oh and “UBI” too. …All without making the trivial connection to realise that these things are exactly the currency devaluation that they’ve been bitching and moaning about, just wearing another hat.

Add in for years they has written about the pitfalls of mass immigration and are now having meltdowns about the slow vaccination rates (the very thing that will prevent the borders being opened).

Exactly.

They keep imagining that things have changed and lessons have been learned and so all the stuff that previously burned them is no longer a risk.

So rates could be dropped because it will restart manufacturing …but for housing it’ll only be pushing on a string. Vaccinations are needed because that will open economy ….without restarting immigration. China can be destroyed because Biden… or something.

living in a fantasy world.

Good to see you posting here PFH. Been some great content posted here in the last week 👍