This is a follow on from my previous article (Using Volatility to Manage Risk and Increase Profits) where I discussed:

- Volatility Adjusting trade size to reduce maximum drawdowns

- Estimating maximum drawdown to decide on how much leverage to use

Volatility-Adjusting works well when back-tested against historical data where all large single day market falls have been preceded with higher volatility. However, there is the possibility of a sudden event that could cause a large and instantaneous falls without giving you any prior opportunity to adjust your trade size. Some examples might be:

- Political Assassination

- Major terrorist attack

- Chinese invasion of Taiwan

The Problem with Standard Stop Losses

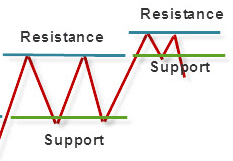

The most obvious solution people think of is a standard Stop Loss. To understand why I believe standard Stop Losses are generally a bad idea (as insurance against sudden and catastrophic losses) let’s revisit Support and Resistance.

If someone else buys out your position at the designated stop level then in all likelihood it means there is support at that level. By definition the price isn’t going much lower, and even likely to rebound.

In a genuine flash crash the support will likely disappear and price will crash through your stop level. It is possible to encounter a much larger draw down than you could cope with, or be completely wiped out.

CFDs a possible solution

Before considering CFDs you should familiarise yourself with the different levels of leverage and margin requirements for each product, as well as the funding costs which are typically LIBOR rate +2.5-3%.

Guaranteed Stop Loss Orders (GSLO)

Some CFD Brokers (CMC Markets, IG Markets) offer Guaranteed Stop Loss Orders for certain markets. Your position will be closed at the specified stop level with the Broker wearing the cost of any additional slippage. You will generally pay a small premium if the stop loss is triggered. I suggest you read the fine print as conditions may vary between brokers.

Guaranteed Stop Loss Order (GSLO) Explained | CMC Markets

What is a Guaranteed Stop? | Guaranteed Stop-Loss Definition | IG

Negative Balance Protection

At the end of March some new laws came into effect for ASIC-regulated brokers. Retail CFD clients are not allowed to lose money beyond their deposit. That means brokers wear the risk of negative equity. These laws apply for all CFD markets including markets where you cannot make use of a Guaranteed Stop Loss Order.

Brokers will tempt you into signing away your retail protections for a sparkling Professional Trading account. If you can handle the extra Retail margin requirements then don’t give up your retail protections.

As usual, read the fine print as brokers will attempt to protect themselves by closing your positions before you run out of equity.

For my own trading…

I use Guaranteed Stop Loss Orders. I see them purely as insurance against sudden and catastrophic losses, and set them far enough away so that they don’t get triggered during periods of low-moderate volatility.

I have also retained the Retail trade account, and don’t have that much deposited with my broker at any one time. I.e. withdraw profits. If by chance my broker changes the terms and conditions on GSLO then I am still covered by the Negative Balance Protection laws.

Disclaimer: not financial advice. These are just my trading ideas. dyor

Another really messy thing is that since Dodd Frank, lots of traditional sell sides have stepped away from providing liquidity.

Their place was taken by hedge funds, which moved from being price takers (global macro types) to being price makers (systematic folks like Citaldel, Sun, Jump etc)

So when vol happens, they pull liquidity, and the entire bid-ask ladder goes pear shaped. Back a few years ago did a lot of work for major asset managers trying to get a handle on so called shadow liquidity, which f’s off the moment you need it.

Ben Hunt (Epsilon Theory) mentioned he shut down his hedge fund soon after the announcement of QE1 with the belief Hedge Funds could no longer outperform the market.

Last year caught out a few traders including some who have written books on money management. They seemed to have made the same mistake of believing that if their money was spread across dozens of stocks each with a 10% stop loss, then whilst they might lose more than 10% on individual stocks that they would be unlikely to lose significantly more than 10% overall.

True. Saw it happen in real time. Also Ben hunts work in mapping narratives is simply brilliant. I’m a big fan.